PILOTs, shorthand for Payments in Lieu of Taxes, are the local embodiment of neoliberal governance, the direction our business-forward, progressive, MaLGA officialdom has been headed for quite some time. PILOTs are legal, voted-upon documents that allow certain expert-approved businesses to engage in Trump-level art-of-the-deal-making contracts with individual city agencies over how much the business will pay them in public taxes.

Not wanting to pay as much on your school taxes or your local transit? Your county library or your waste disposal systems really got you bummed? The PILOT idea seems to be: just build an addition onto your house!… and we’ll let you negotiate directly with agency leaders to personalize a menu of discounted ad valorem rates for your post-renovation property tax assessment.

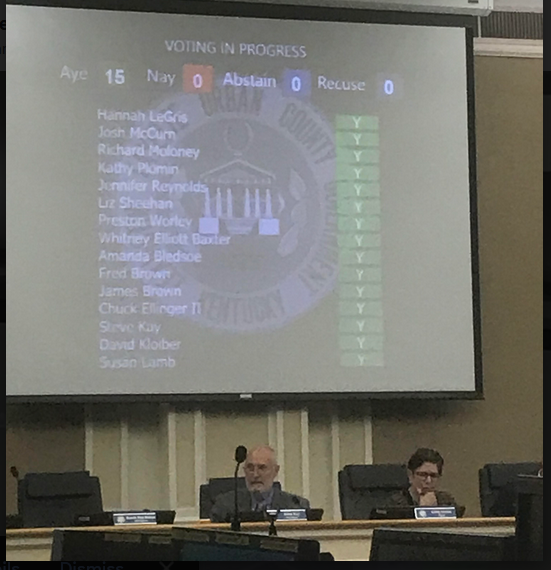

This may sound funny, but last week this is exactly what our elected Lexington-Fayette Urban County representatives voted to do for the mysterious development company Astana LLC. In order to help Astana build a boutique hotel located behind the public-subsidy-pit we know as Rupp Arena, Council voted unanimously and without discussion to approve four separate PILOT agreements between Astana and a handful of city service agencies. These agencies were Fayette County Schools, the City Library, the Health Department and Lextran.

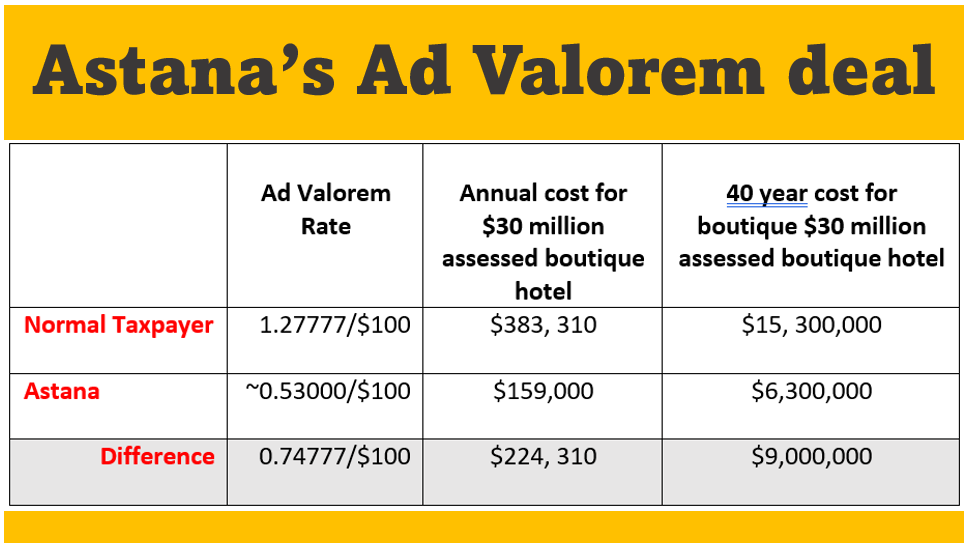

All told, the four “Payment in Lieu of Taxes” deals reduced the anonymous company’s annual property tax payments (what you and I, mere mortal taxpayers, pay to run the city) by nearly 60%, an estimated $225,000 a year in savings…for the next 40 years.

Since the Astana PILOTs promise to be the first among many coming our way, it is instructive to know how they operate, and why our city leaders are such unanimously craven neoliberal Whigs for legitimizing them.

Tax payments: the radical egalitarianism of the bad old days

In the bad old days, one moved to a community and simply paid the taxes that came from living in it. Full stop.

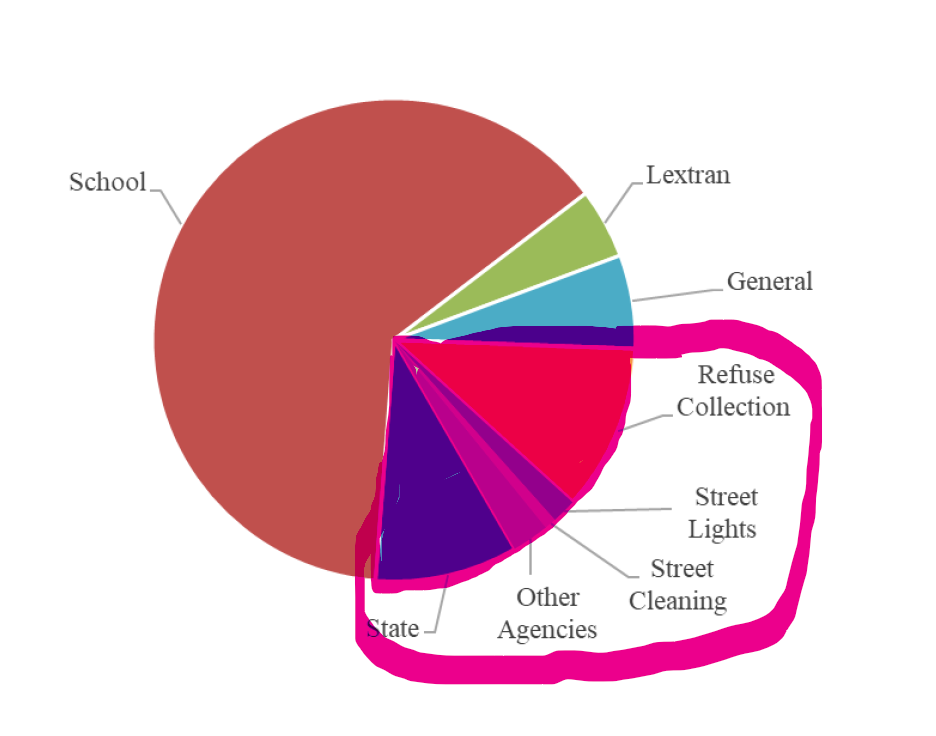

We all paid a set rate of ad valorem (property) taxes, occupation taxes, and the like. These payments, in turn, paid into several funds that kept Lexington running: paved streets, mowed parks, quality schools, clean running water, the garbage disposed of. Look, here’s a cute graphic to show you how these break down for property taxes in Lexington:

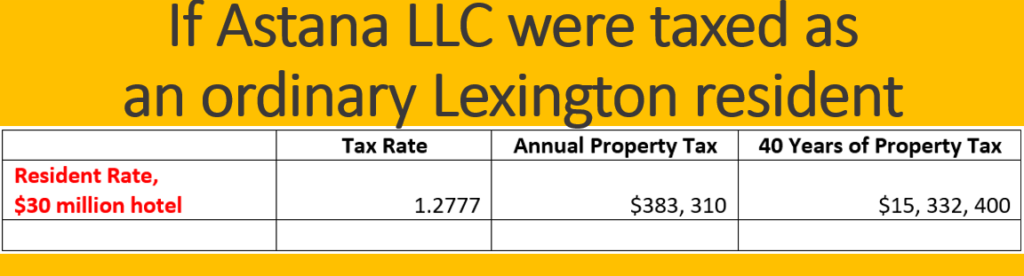

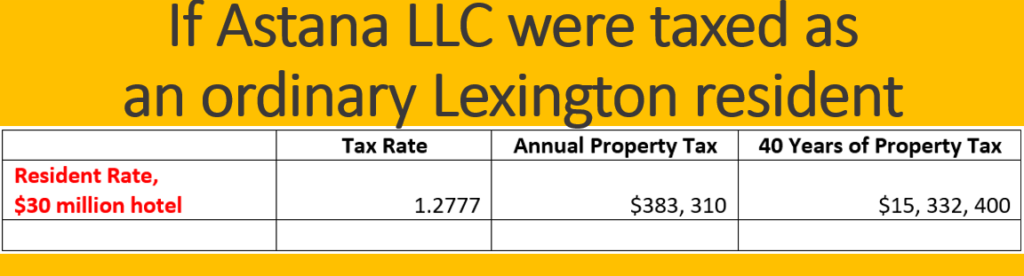

Most of us, of course, are still living in those bad old days. Our wages, salary and profits are taxed at the same 2.25% Occupation tax rate, and in the case of our local Ad Valorem (aka “property”) taxes, we all pay $1.2777 for every $100 that our property is assessed.

This 1.2777 property tax figure comes from adding up the assessments for nearly 10 agencies. Of the 1.2777/100 rate, schools receive 0.81/100. The public library receives .05/100. LexTran, .06/100. Other agencies include the Health Department (.0280), Garbage Collection (.1426), Street Lights/Cleaning (.031) and the State (.122).

Here is what an assessed $30 million boutique hotel might pay in ad valorem taxes during Lexington’s bad old days of radical egalitarianism.

At some point, city and state and federal leaders began handing out a fistful of different tax-breaks to their wealthy friends and neighbors, mostly for projects that would have happened anyway at no public cost (or, more often, have just fizzled away harmlessly). These complex tax subsidy schemes created new terms and metrics useful for robbing the public commonweal—the tax increment, industrial use, blighted area, tourist attraction, and the like.

For the most part, though, the different complex robber-baron tax breaks featured equal cuts across the board. Just about all levels of local government got screwed in equal fashion.

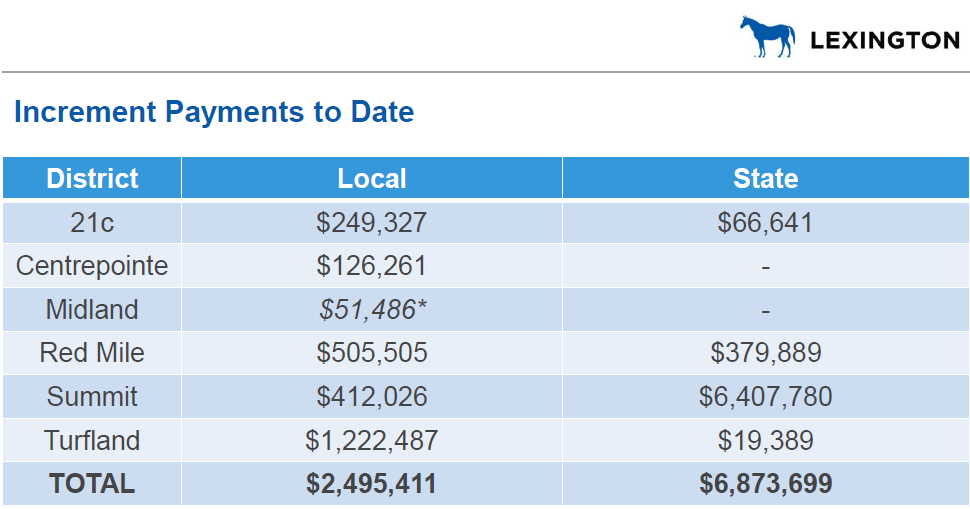

Take, for example, the 2013 vote by city leaders Steve Kay, Linda Gorton, Richard Moloney and others to enter into a $50 million Tax Increment Financing (TIF) deal with the developers of the CityCentre development for what became an underground parking lot. That complex robber-baron tax break, the TIF, was positively Bolshevik in its comradely sharing of burden among all city services (save the exempted Fayette Schools) whose budgets relied on the collection of property, occupational, sales or income taxes. (The last two are state taxes.)

Terrible as these giveways were, the across-the-boardness of the subsidies implied a need for wise, judicial, thoughtful public servants—or at least the appearance of such. To support a project like the underground CityCentre parking lot, city leaders had to actively ignore Fayette Urban County constituents like Anne Donworth helming the Lexington Public Library or Jill Barnett running an underfunded LexTran bus system.

With PILOTs, though, our City Council leaders seem to have thrown in the towel altogether on the pretense of governance. Not only do PILOTs now transform tax payments into something individually negotiable at the agency level, such agency-level negotiations will occur in private backroom deals in which our elected representatives, curiously, have no seat at the table.

Perhaps too exhausted or traumatized to actually lead, Council seems to have relegated their job with PILOTs to a formal ratification of whatever the hell comes out of these Shark Tank agency negotiations. We have a word for that action: rubber-stamping.

A New Deal to make Payments in Lieu of Taxes

You could see this Just let us know how things go, Nikkie!-style of leadership in the May 25 Council meeting in which the Astana PILOTs were first introduced.

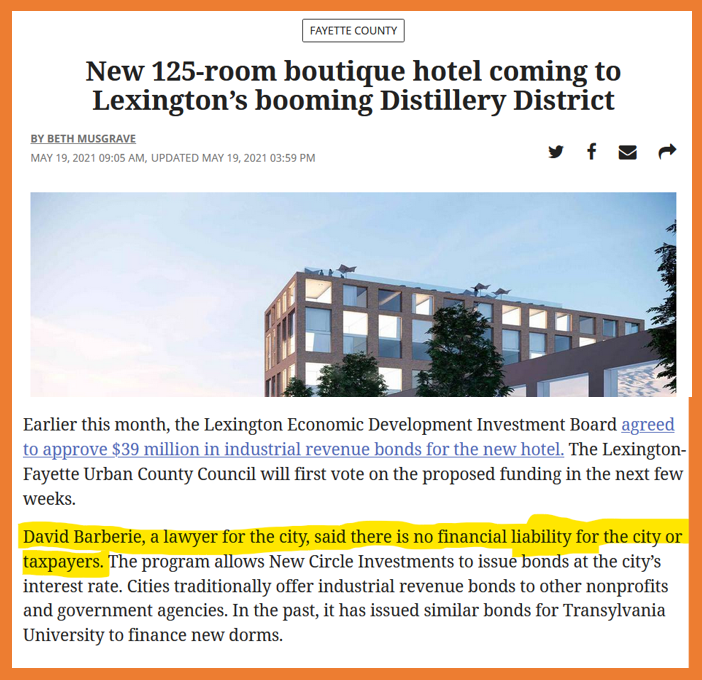

That meeting was supposed to include an Astana presentation to Council and a pro-forma first-reading of an accompanying ordinance to issue the anonymous boutique hoteliers $40 million in Industrial Revenue Bonds (IRBs). (You can read my report here on IRBs, which are a type of municipal bond (loan) in which a city or state operates as a pass-through entity for investors to loan money to a private business looking to build or expand its industrial capacity.)

While Astana did deliver its Council presentation, the accompanying June 10 first vote was postponed two weeks because of an IRB quirk that featured…PILOTs!

Because the Astana IRB loan technically represents both city-issued debt and also a federal tax giveaway, the city is required to own the land related to the project. For the anonymous Astana hoteliers to get at the millions of dollars in federal IRB subsidies, their Boutique Hotel property must be transferred to the city for the 40 year term of the bond. (In less progressive cities, IRBs help to build schools rather than boutique hotels, and so this is no big deal since most of the properties are already publicly owned.)

In a variation on the Heads I win! Tails I win! nature of corporate giveaways, this quirk releases Astana from paying property taxes on a development that it predicts will be assessed at $30 million. At a 1.2777 property tax rate, this Astana IRB quirk would cost the city $383,000 per year in lost property tax revenue. Over the 40 year Astana IRB, the lost city revenue is on the order of $15.3 million dollars.

Enter the PILOT.

Leading up to this May 25 meeting, Astana sought to deflect attention from its local property tax grab by entering into a Payment in Lieu of Taxes (PILOT) agreement with the Fayette County Public School System. The PILOT ensured that even if the future hoteliers would absolutely not be paying property taxes, they would at least be making payments to help Fayette’s poor little school kids.

In reality, though, Astana’s PILOT agreement with Fayette Schools allowed Astana to keep much of its property tax break while allowing both sides (Astana reps and Council reps) to puffer-fish about the minimal effect this unfortunate IRB quirk would have on city taxpayers and government.

This puffer-fishing was a strategic lie on several fronts. My last article on the Astana IRB listed the hidden millions in state and federal giveaways that are part of Astana’s deal with their community (and, by extension, with any city taxpayers who also consider themselves members of the state of Kentucky and the United States of America.)

But even at the local front, a close look at PILOTs demonstrates how the anonymous hoteliers were using complex language to receive special-privilege tax-breaks to build their boutique hotel behind Rupp Arena.

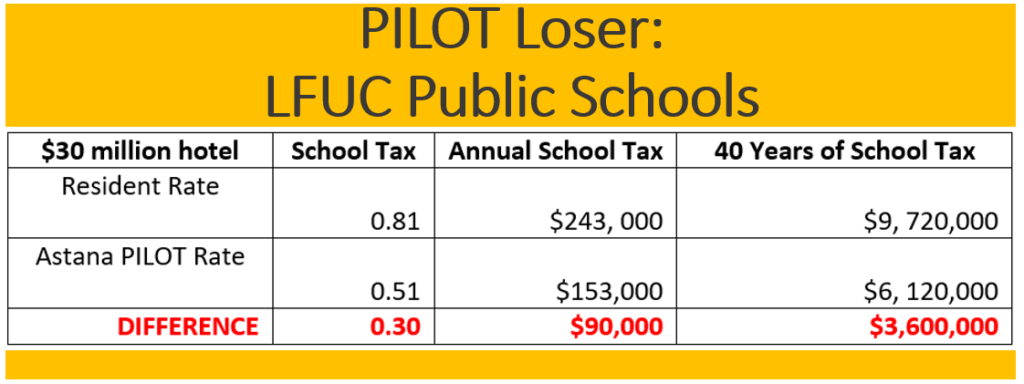

Here in table form is how the Astana PILOT agreement with LFUC Schools actually worked out. The PILOT saved the hoteliers close to 40% on their School tax bill (or, conversely, robbed our local schools of close to 40% of what they were due): $90,000 a year, $3.6 million over the 40 years that the city will hold their deed.

You may have guessed where all this inefficient and tax-base-depleting Whiggery might be heading, though Council and our local media seemed to have missed it: private PILOTs for all of our city agencies!

And this is sort of what happened. Council postponed its original May 25 Astana vote after hearing representatives from the Fayette County Public Library demand their own PILOT agreement with Astana.

One might think that, at this point, city leaders might have paused to re-evaluate the process of having a private development company to engage in unsupervised individual tax negotiations with every single agency that depends on property taxes to operate.

Alas, that’s not the City Council we have. After the Public Library revolt, city leaders (led by Big Whigger Steve Kay) just gave Astana two more weeks to meet with Library officials to negotiate their own PILOT agreement. And because our Council Whigs want us to know that they care about the poor among us, they also directed Astana to meet with LexTran, too.

Let that sink in for a second.

The PILOT New Deal

In the end, Astana did exactly as their Council leaders instructed them to do. They took two weeks, brokered new tax deals with the LexTran and Library agency heads, and returned to Council on June 10 with their PILOT documents in hand. (The Health Department PILOT would be added on June 24.)

Nobody seemed to care that these were shitty PILOT deals, at least if you are a user of our city’s library system or a rider of its intermittent bus system. That was to be expected: our agency heads are neither Shark Tank players, despite being thrown into the shark tank by their elected Council leaders.

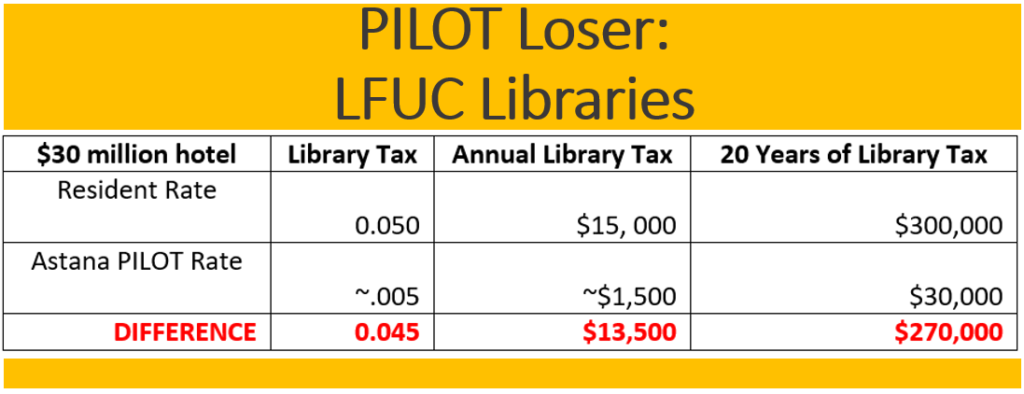

Here is the Astana PILOT for the public library. They lose 90% of the funding that they could expect if you or I had built the hotel.

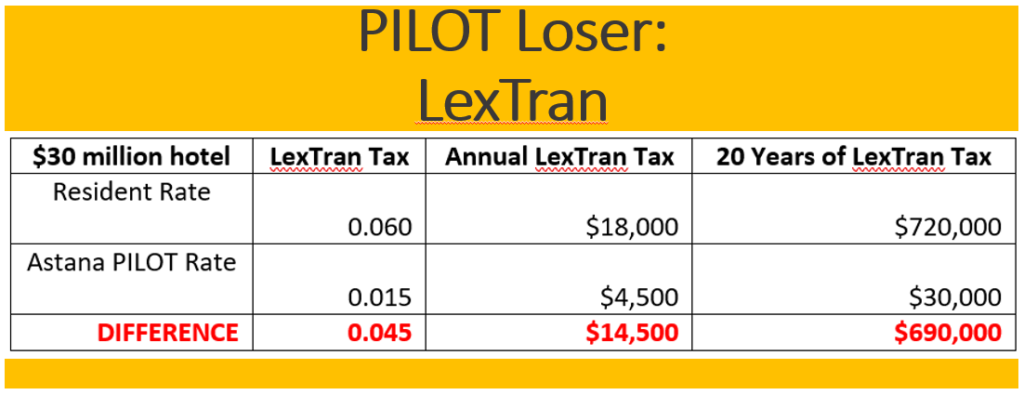

And here are the PILOT terms for our LexTran bus service. They lost about 75% in tax revenue when Council Whigs sent them into the Shark Tank with Astana.

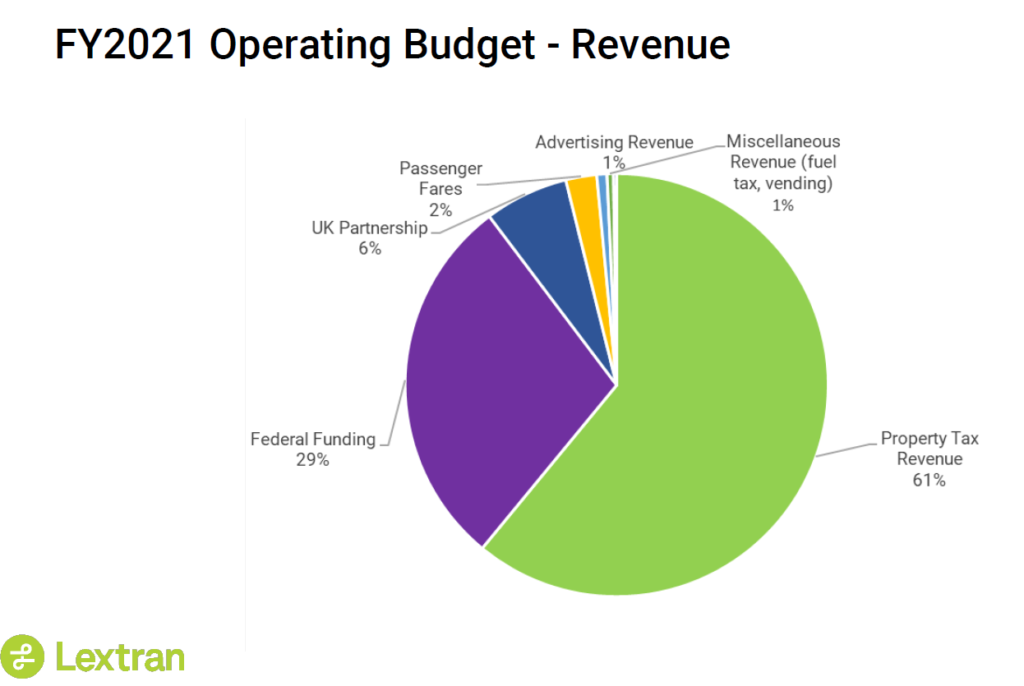

And just as a reminder, here is how much of the LexTran budget comes from the property taxpayers of Fayette County.

Of course, these agencies are PILOT losers, but the thing with PILOTs is how they create different levels of citizenship–a feature of neoliberal governance generally. LexTran, Fayette Schools, the Library, the Health Department–these were favored institutions who were “lucky” enough to get a small bit of clawbacks, mainly because these agencies have friends in government (or, as with LexTran, occupy a prime media/activist space for doing “poor work.”)

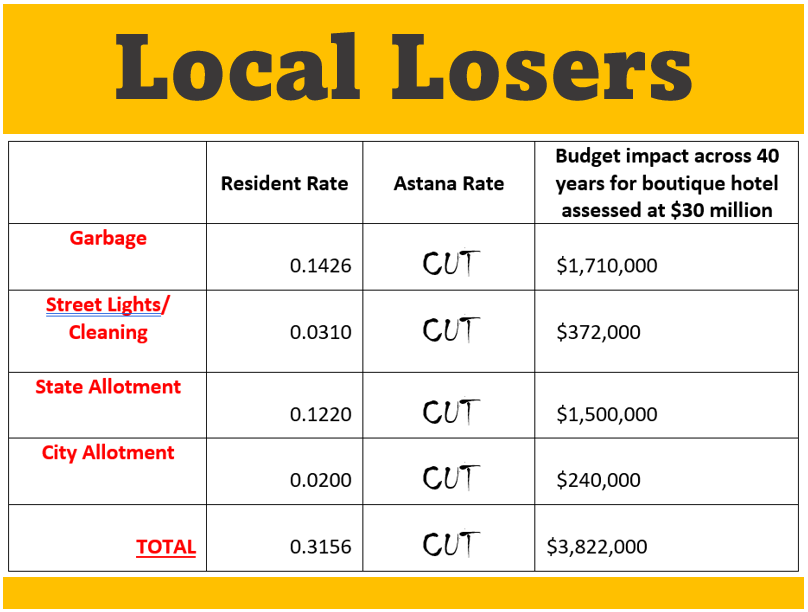

But not every agency was so lucky or connected. Most got no PILOTs at all. These second-class agencies include trash and street lights.

It’s late and I’m on deadline, so I’ll leave you with the underside of Whig PILOTing: the left-behind, the non-PILOT local losers, who were not mentioned once by our Whig Council in their rush to help build Lexington yet another subsidized boutique hotel.

Leave a Reply