If Tax Increment Finance (TIF) zones emanated from Washington DC, we would easily identify them as trickle down economics designed to enrich the already-enriched, the foul byproducts of a fat-cat Trumpism or an elitist neoliberalism—and we’d dutifully fill our Facebook and Twitter feeds with heartfelt and witty denunciations of them. We’d shake our fists at the corrupt politicians who had awarded them. We’d shift our consumer preferences away from the fatcats who stood to profit from them.

But since TIFs are instead sourced locally, mainly we tend to view them as anodyne progressivism. And who knows, maybe they are.

I was reminded of this last Friday afternoon, when the Lexington Herald Leader published a long update on deteriorating state support for Tax Increment Financing (TIF) zones.

You may have missed this TIF update. The article appeared briefly on the Herald Leader main page, just under a headline announcing that some local members of the #resistance had raised the necessary $5,000 to bring a Baby Trump balloon to Lexington for the President’s visit to campaign for Republican Governor Matt Bevin. A few hours later, however, the TIF report had disappeared from the main page entirely, only to re-appear briefly on Saturday morning, this time hidden as the third of five articles placed under the Local News tab. The report would not appear in the HL‘s print version until Monday, at which point it had already disappeared from the HL website.

And unlike the Baby Trump balloon story, covered by the Courier Journal, Lex18, WLKY, and WKYT, this TIF story went otherwise unnoticed by other media outlets.

For those who missed it, the article focused on recent decisions by the Kentucky Economic Development Finance Authority to reduce state TIF subsidies for three recently-approved local projects: the Fountains at Palomar on Harrodsburg Road, the UK Coldstream Research Park on Newtown Pike, and Rupp Arena.

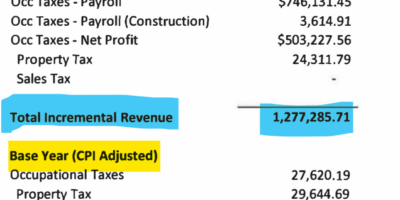

Tax Increment Financing subsidies are annual rebates given to private developers for projects that are claimed to provide ‘public infrastructure’. The idea is that, in areas that generate little in taxes (slums), a single large development will stimulate nearby investment and produce increased tax revenue throughout that area. Economists measure this impact by the tax increment, or the difference between what an area generated in state and local taxes before the large development occurred, and what it generates after development. In TIFs, private developers are given rebates for up to 80% of the tax increments that occur within a set area, normally over a 20-30 year time frame.

There are any number of reasons to suspect that TIFs are the brainchild of regressive, vaguely racist, free-market Republicans. For beginners, trickle down assumptions under-gird the entire thing. TIFs enable governments to shuttle public money into the coffers of private developers in order to perform the historically public sector work of providing public infrastructure. (We have developed a word for this over the years: outsourcing.) By definition, TIF subsidies are only available to fat-cats, those with the reserve capital and political connections to pull off projects that start at $10 million and run to the hundreds of millions of dollars. Scrappy small business owners these are not.

Then there is the original reason for such subsidies: TIFs began as a way to extract value from newly fashionable inner city slums that were poor and largely black. These decrepit locations, with their aging sewer systems and crumbling sidewalks filled with poor people, were the products of nearly a half-century of no private investment and public infrastructure upgrades. Such upgrades, it should be noted, instead went to the creation and development of the suburbs, which were overwhelmingly stuffed with white people. In a sort of heads-I-win, tails-you-lose situation, TIF subsidies were designed for developers to counteract this racially tinged history at the exact moment when money and white folk were moving back to the city–and poverty was moving to the suburbs.

There is also the econometrics involved. Using tax increments to chart the eradication of a slum is sort of like using a country’s GDP to measure its economic health. Rather than direct attention to the inner city people and communities who have endured the half-century of slumming, TIFs instead rely upon business eggheads to produce opaque data points (tax increments!) whose geographic parameters (the TIF zone!) and disbursement time frames are easily gamed to exclude the very people and needs that they were ostensibly created to help.

Add things up, and we have a program that allows a few private developers to operate within TIF zones as a type of shadow government. TIF developers, who are unaccountable to voting citizens, define the infrastructure needs for their TIF zones. And TIF developers, rather than low-income slum residents, can expect to receive most of the tax monies: nearly 80% of local and state taxes, for a 20-30 year time period.

TIFs and Fayette urbanism

Despite appearances, TIF zones are not the product of a Washington D.C. political culture. Rather, TIFs are approved by two other political bodies that are located in two different locations: by the state, located in Frankfort, and in Lexington, by city officials. These two entities, we are told, operate along different political and economic principals. On the one hand, we have a state leadership in Frankfort comprised of free-market rural Republican kleptocrats who are adept at politicizing state oversight boards to provide their fat-cat donors a slew of Commonwealth-killing subsidies. And on the other hand, we have local Fayette County leadership–urban, data-focused, UK-proud, and dominated by Democrats.

Yet when it comes to endorsing TIF projects, the article presents readers with a political conundrum: it is the corrupt state leadership that has begun to limit TIF giveaways to wealthy developers. Further, these education-averse neanderthals are basing their decision in part on an examination of the disappointing data produced by previous TIF projects. In the case of the three recent Lexington TIF projects detailed in the article, the state had sliced off nearly $60 million in rebates by reducing its percentage of pledged state tax increments from 80% to 40%. Future projects, the report stated, could expect similar reduced state subsidies, a decision based in part on growing evidence of the general “poor performance” of the state’s 35 TIF zones.

And though this point is less pronounced, the article is also clear on where our local mostly-Democrat city leaders stand: as state support dwindles, our elected body of Fayette County leaders have maintained their full support, funding the local end of these TIF agreements by the maximum allowed 80% of local tax increments.

Such was not always the case. In 2008, when the city was represented by a Republican Mayor, leadership was divided on the value of directing $25 million in Tax Increment Financing to Dudley Webb and his CentrePointe project. The subsequent vote to approve the CentrePointe TIF district, the city’s first, was contentious and only passed by a rare split 10-5 count.

At the time, the Herald Leader, which has always been a pro-Democrat rag, raised many of the same flags as I have above: a high-cost project with questionable private funding whose main beneficiaries were political donors to the (Republican) Mayor. Lexington progressive oracle Tom Eblen even went so far as to label the TIF idea as “lipstick on a pig.”

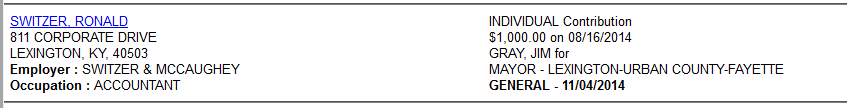

Since 2010, however, when a Democrat Mayor came to power, the city and its thought-leaders have flip-flopped on the value of TIFs. Since that time, the city has fully funded all Lexington TIFs that have appeared before council, including several TIFs denied by the state and a renewed authoriziation for the CentrePointe TIF, which was set to expire in 2013. (Members of the Webb Company, it should be noted, donated $4,000 to the Jim Gray campaign between 2013 and 2014.)

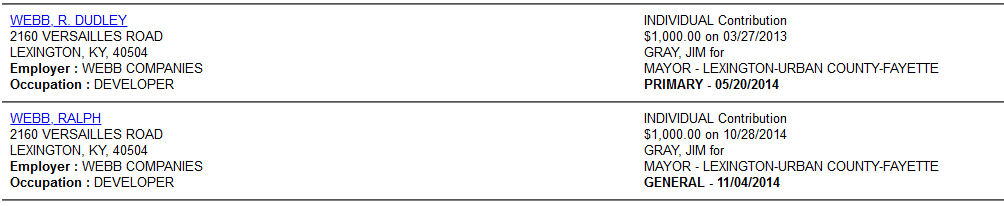

The most recent of these giveways are the $3.6 million of local taxes for Fountains at Palomar; the $16 million for UK’s Coldstream Research Park; and the $11.6 million for a Rupp Arena renovation. But earlier TIFs from the Jim Gray era went to renovating 21C Modern Art Hotel, upscaling the city’s East End, ripping up a suburban farm for a modern mall, and redeveloping the Red Mile horse track for private-market UK student housing and Turfland mall for an expansion by UK healthcare. And in a nod to Donald J. Trump, the businessman President, each of these TIFs directly benefited people who were major political contributors to our own local businessman-turned public executive, Mayor Jim Gray.

If anything, the local trend has been toward further council unanimity and less media oversight. The most recent TIF zones have been awarded on expedited local votes that notably sidestepped time for public debate. To give one example, the council vote to give $16 million in future tax increments to the University of Kentucky to develop its UK Coldstream Campus, a vote for which I was present, took all of two minutes. If one didn’t know any better, one might think they were in Frankfort watching pro-business Republicans pass a sewer bill.

Except, of course, that when the sewer bill was passed in Frankfort, it was amply covered by state media and circulated widely on our Twitter and Facebook feeds. By contrast, our local TIFs coverage and circulation have been slow and deferential. One is hard-pressed to find a single instance of a local elected official speaking on the record about TIFs; coverage has often avoided the issues of corruption and cronyism bound up in a council that votes to direct tax funds to donors of Democrat Mayor Jim Gray.

Where are the Baby Jim Gray dolls?

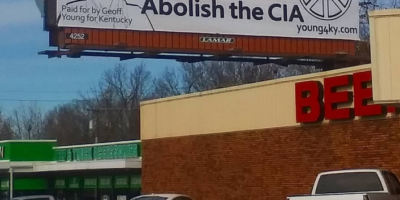

As I finish writing this piece, Democrat demonstrators have gathered downtown to protest the Lexington arrival of Republican President Donald Trump and Republican Governor Matt Bevin; Baby Trump is already on the scene and floating around. We can be sure that, in the circus that follows most Trump protests, the grievances lodged by demonstrators in their various chants and signs—pension cuts, tax giveaways, secretive governance, cave-man morality—will be both well-founded and amply covered.

But as Lexington demonstrators meet downtown to protest Trump and Bevin, I hope they cast their eyes beyond the orange shade of Baby Trump and take a look at the more intimate free market Republicanism that has taken shape in their own city.

Photo by Julie Mayer.

They shouldn’t have to look far. Baby Trump is anchored on the grounds of the New Courthouse, which sits across from City Center (formerly CentrePointe) and its $25 million in local tax increments that, by a 15-0 vote in 2013, will go to developer R. Dudley Webb. As they walk down Main Street to protest the vile Republican politicians stumping there, Democrat protestors will no doubt pass the renovated Old Fayette County Courthouse, whose new businesses (also subsidized, by a 15-0 vote in 2016) are producing tax increments that, because they are in the CentrePointe TIF zone, will mostly get paid to R. Dudley Webb. Perhaps these #neverTrump protestors can make it a point to commiserate with some of their fellow protestors who attend or work at UK about the local tax increments that will help UK construct its Coldstream Research Campus (passed 2018, 15-0 vote).

And as they arrive at Rupp to shout shrill somethings at the President and Governor, I hope they take a moment to draw up future protest signs that call attention to the $11.6 million in local tax increments (not to mention the other $200 million in local subsidies) our Democrat mayor and his Democrat-heavy city council voted into existence four years ago.

1 Pingback