This Thursday, LFUC City Council will devote time to hear citizen input about a proposal to issue $40 million in Industrial Revenue Bonds (IRBs) to the mysterious development company Astana LLC. Astana plans to use these funds to construct a boutique hotel on the backside of the city’s Rupp Arena expansion.

You can read my earlier report on the Astana IRB here. That piece gives some background on IRBs and attempts to explain how in the Fayette Urban County a boutique hotel could be considered an “industrial” concern eligible for such bonds.

This post will ask a few of the “money” questions that our whiggish City Council representatives and local media have thus far avoided publicly considering, most likely because…they don’t want you to know the true costs of the proposed Astana IRB.

Here we go, question 1.

1. Do city leaders know about Astana’s $7.2 million state tourism subsidy?

As alert reader Yong Guan pointed out, Astana LLC applied in July 2020 for $7.2 million in Kentucky State Tourism and Development subsidies, a full year before it would appear before LFUC to request $40 million in Industrial Revenue Bonds. Is Astana getting these state subsidies in addition to whatever it can make off its $40 million IRB through the city?

On Friday, I contacted Mona Juett from the agency that oversees the state’s tourism subsidies to ask about the Astana application.

I am still awaiting an answer to my questions. I’ll report back when I know more, but at the moment let’s just say that it is quite possible that as Astana came begging LFUC Council Members to give them a $40 million IRB subsidy….it already had in its pocket a $7.2 million state subsidy.

But even in the unlikely case that Astana was turned down for the Kentucky Tourism and Development subsidies, its 2020 cost projections and subsidy “ask” of state taxpayers are worth a closer look, as is the timeline for Astana advisor and UK Hall of Fame member Bill Lear’s association with the mysterious development group.

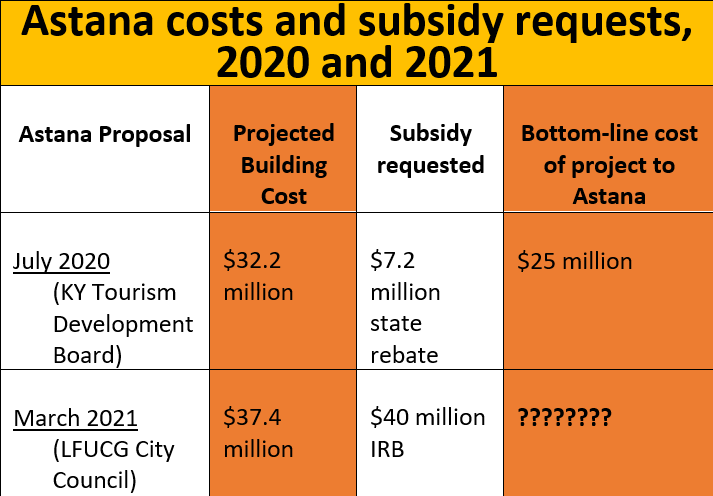

In July 2020, Astana listed construction costs at $32.2 million. The tourism subsidy would rebate $7.2 million of that amount for a bottom-line $25 million construction cost to Astana. (This amount does not include financing costs, about which we’ll get to in Question 2.)

A year later, Astana’s March 2021 IRB pitch to the city’s Industrial Review Board listed construction costs at $37.4 million, a 16% ($5.2 million) increase in less than a year! Here is that change in a graph.

More amazing still is how Astana’s request for $7.2 million in state tourism taxes were left out of the City Council discussion of Astana’s IRB bonds. Seems like this information would be important, and yet the subject never came up at Council, nor has it yet been mentioned in local media (outside, of course, of this community-despised paper). Is this omission intentional, or just a University City-patrolled form of buyer-beware ignorance?

In his May address to City Council, Astana’s Nik Feldman cited increased Covid costs of construction material as the chief reason Astana needs the city to quickly issue it a $40 million Industrial Revenue Bond. Yet Feldman’s own projections reference an 8-10% cost increase—good for maybe $3 million of the $5 million cost creep between his 2020 proposal to the state and his 2021 proposal to the city.

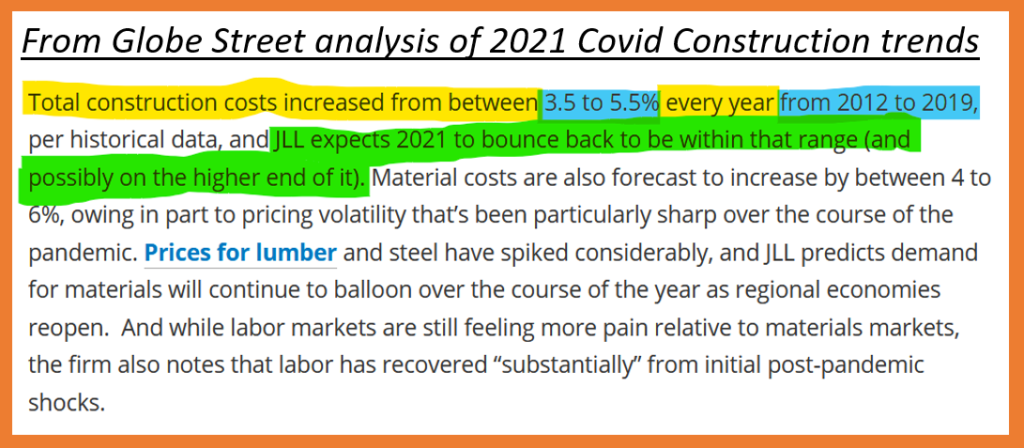

But even if you grant increased construction costs (a private-sector issue hardly relevant to the business of city subsidies), Feldman’s cost-increase projections for his Astana project are seriously inflated, at least according to people who follow the construction industry.

This Globe Street market analysis of the construction industry notes increased construction costs will fall on the high-side of recent trends, but it predicts this inflation as adding only about 5.5% to project costs. (Another industry source, the international construction services company Turner Construction puts the increased costs at much less than 5.5%.)

Even if you buy the ‘our costs are going up!‘ argument, Feldman is incorrectly presenting normal cost inflation as a unique and challenging price spike. Who to believe? I’m going with the experts over the collegiate horse-polo star.

A few more questions also follow from news of Astana’s state tourism subsidy:

Is the $5.2 million increase in Astana’s 2021 cost projections just pure profit? A function of how the IRB is structured that gets their bottom-line costs back to $25 million? Or is the company that is requesting a special $40 million partnership with Lexington just in the habit of “making shit up” as they go along, including the cost projections to build their $32 million–or maybe its their $38 million–project?

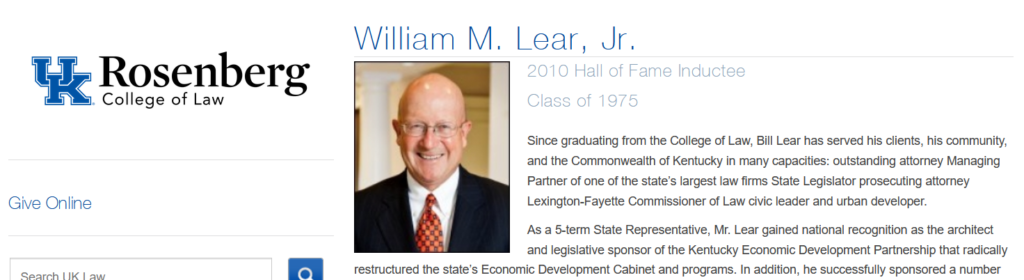

At the same May meeting with City Council, the noted Lexington lawyer-politician and UK Hall of Fame member Bill Lear claimed that the secretive hotelier group only approached he and his Stoll Keenan Ogden law firm in March of this year. That timeline always seemed, on the face of it, to be a bit strained: March is when Astana presented its IRB proposal to the city’s Industrial Review Board, meaning Lear had little time to review the Astana IRB proposal before pitching it to our city leaders as a unique $40 million community benefit in need of their support.

(Alternatively, it could be that unprepared goofball proposals are what this city really values, and that the clown Lear is the right man for the job…)

However, if Lear was a part of the 2020 Astana pitch for $7.2 million in State Tourism funds, then his lie to sitting city council members just got a whole lot more outrageous and deceitful.

Is that precedent—bold-face lies to elected city representatives during special meetings in order to get your clients a $40 million city-issued subsidy—something that our current crop of elected officials are OK with? Exactly what does the rich-kid Lear have to do to be put back in his place as a regressive, damaging, truth-challenged member of this community, stripped of his special privilege to interact directly and for long amounts of time with city leaders?

2. Do city leaders know how much the $40 million IRB will benefit Astana? Are they aware how IRBs affect me as a tax payer?

The gimmick for an Industrial Revenue Bond is that the city or state originates the construction loan rather than a bank or some other private entity. This arrangement benefits both the bondholders (those who front the money by “buying” the debt) and the developer.

Because an IRB is issued by a government entity, its bondholders receive federal tax breaks on the interest they charge to underwrite it (good for the bondholder). This tax benefit then induces bondholders to charge lower interest rates on the debt being issued (good for the developer), thereby reducing the developers costs on the back end.

Along with our paper of record, the city’s own lawyers have presented this IRB gimmick as having no effect on city taxpayers, mainly on the evidence that an Industrial Revenue Bond is not backed or in any way tied to the city. Here is the initial May 19 report from Herald Leader journalist Beth Musgrave, where she presents the IRB statement of LFUC lawyer David Barberie as objective journalism.

Barberie’s sentiment may be factually true in a very narrow sense—but it is also practically useless for understanding the tax-effects of IRBs on city residents.

IRB subsidies do not come from nowhere. Companies like Astana can expect discounted rates because the people underwriting their loans (the bondholders) are not taxed by the federal government on the interest they make off servicing the loan. So while it is certainly true that, in the case of Astana’s IRB, those lost taxes will not come out of the Lexington-Fayette Urban County budget, it is also true that the taxes will come out of the United States federal budget—into which most Lexingtonians absolutely do pay.

(Of course, maybe Council Members like Steve Kay and Liz Sheehan–like city lawyer David Barberie–just don’t really see themselves as Americans…just good Lexingtonians.)

While it is hard to put an exact number on the federal discount, at least one IRB-issuer, the Upper Illinois River Valley Development Authority, writes that the tax-free IRB status “allows the borrower to reduce the rate of interest he/she would normally obtain on a conventional loan by 2-3%.” (An older study of IRBs, Robert Giloth’s “Designing Economic Development Incentives: The case of Industrial Development Bonds in Chicago, 1977-87,” puts the discount Astana might expect at “25-35% below market interest rates” for the loan.)

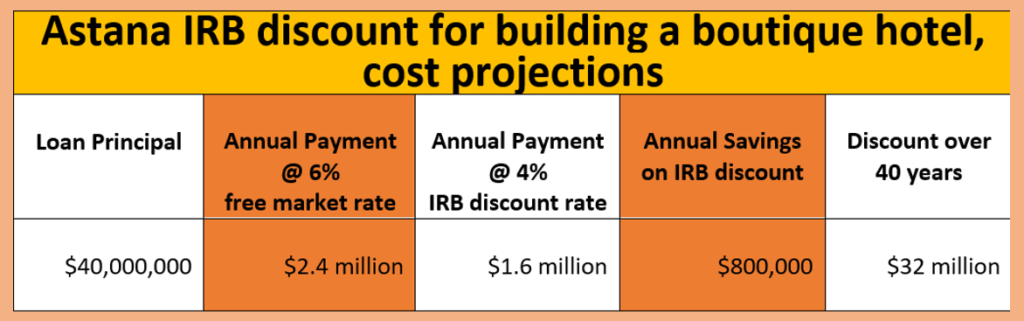

If we assume a 2% coupon rate discount on a $40,000,000 government-issued bond, the Astana savings come to $800,000 for one year. At that pace, Astana would surpass its 2020 Kentucky Tourism subsidy in 9 years. Multiply that annual subsidy by the 40 year term of the IRB bond, and the city’s IRB subsidy to Astana may hover somewhere around $32 million in federal taxes. Since bondholders are by definition nearly all wealthy investors, this $32 million subsidy will directly benefit the wealthiest among us in this country.

Here is this calculation in graph form.

Do council members believe that this allocation of federal tax dollars, over $30 million spread over 40 years, is acceptable? For the act of building a second Lexington boutique hotel, this one with onsite brewery?

These are things that I’d like to know as a city resident. Thus far, our lame city debate hasn’t allowed our elected Council Members to go on record about the value of these subsidies that they are awarding, and how such subsidies are interacting with any other handouts Astana may or may not be getting. It’s about time they begin being less intentionally ignorant.

You can ask Council Members these and other questions at the June 24 City Council Meeting, which has been designated a “Citizen Input” meeting for the Astana IRB.

1 Pingback