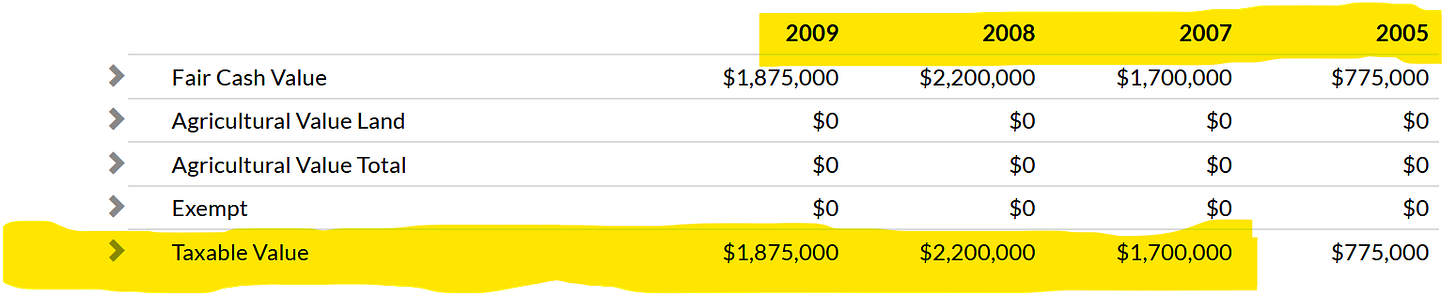

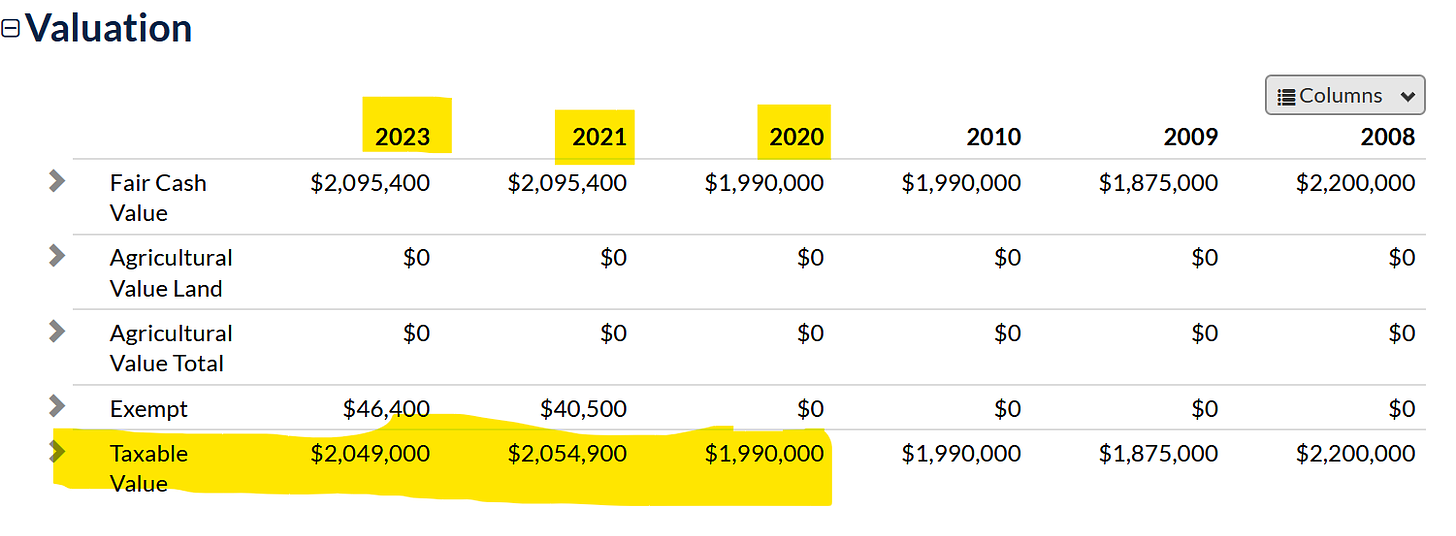

John Calipari arrived to Lexington from Memphis on an 8 year, $34.65 million contract to coach the University of Kentucky boys basketball team, the pride of the Bluegrass. A month later, May 14, 2009, he and wife Ellen purchased a 9,500 square foot, 6 bedroom, 8 bathroom, in-town home for $1.875 million.

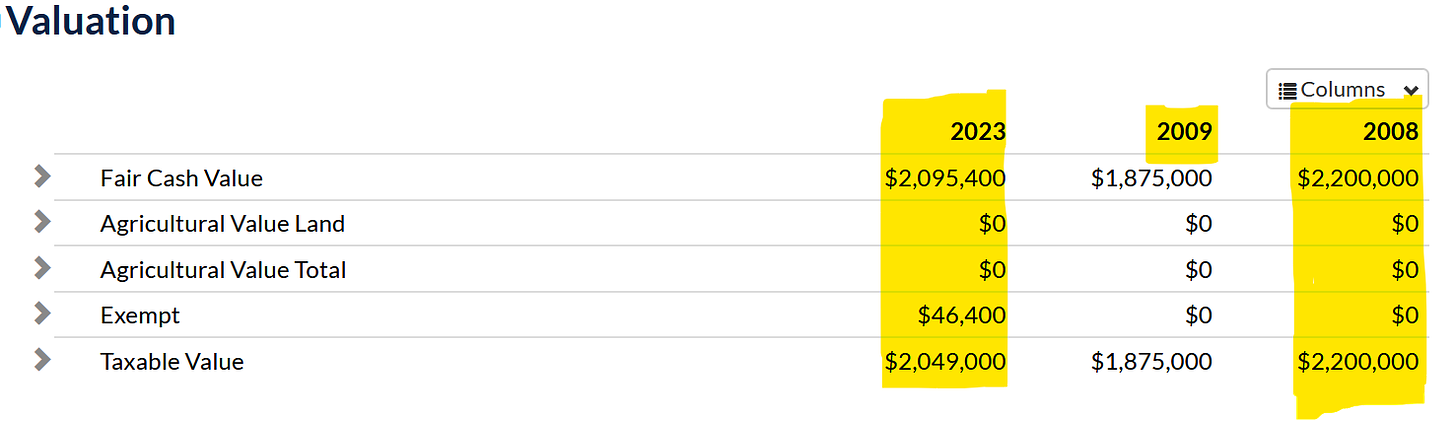

Reflecting their purchase amidst the collapse in home values precipitated by the Great Recession, the Calipari’s acquired their forever home for $375,000 less than its 2008 tax assessment of $2.2 million.

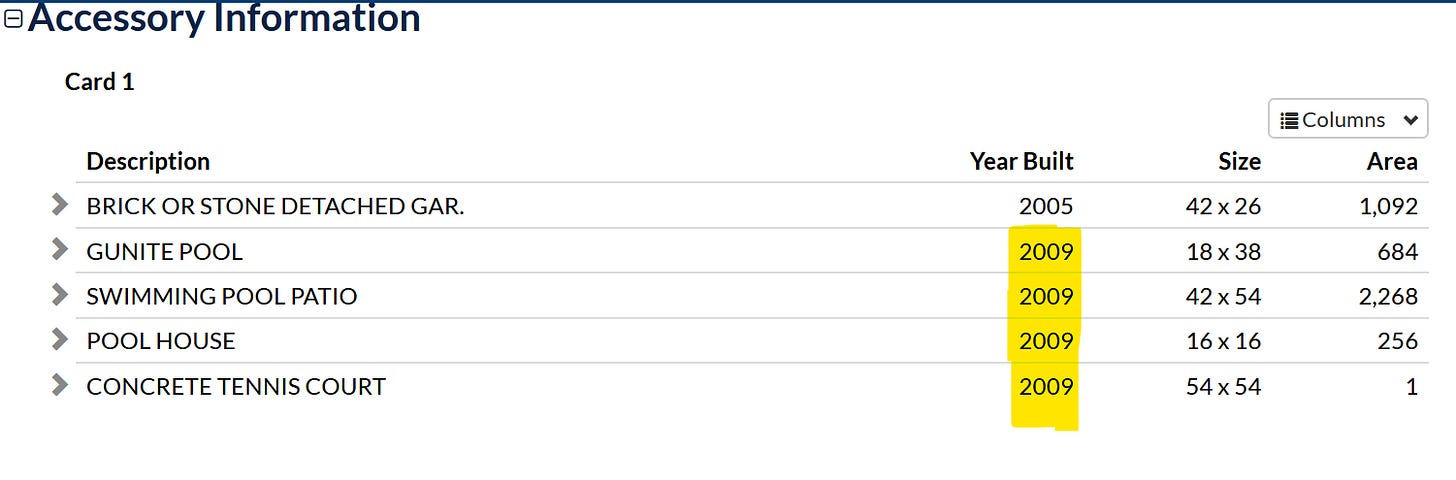

The same year, 2009, the Calipari’s added to their home a pool, a pool patio, a pool house, and a tennis court.

Reflecting these additions, the next year, 2010, the Calipari’s received a marginally increased tax assessment of $1.99 million, or a $115,000 increase over their $1.875 million purchase-price assessment. Since the cost and added value of a pool, pool patio, pool house, and tennis courts far exceed $115,000 (or else maybe the Calipari’s should go into affordable housing construction!), the 2010 assessment, charitably put, likely reflects the PVA’s determination that the Calipari homestead was continuing to lose value as the Great Recession continued to unwind real estate values locally and across the nation.

PVA protocol is to re-assess properties at least every 4 years. This schedule ensures that any increase or decrease in assessed value does not occur by leaps and bounds. This assessment timeline also helps efficiently identify and tax appropriately “hot” and “cold” segments of the Lexington housing market.

The Breaks

I have written before about how longtime Fayette County PVA David O’Neill has repeatedly ignored that 4-year protocol for select community members who are often publicly identified as leaders in one fashion or another and who wield large amounts of community influence. The Herald Leader’s Aaron Mudd has also reported on a few instances of this.

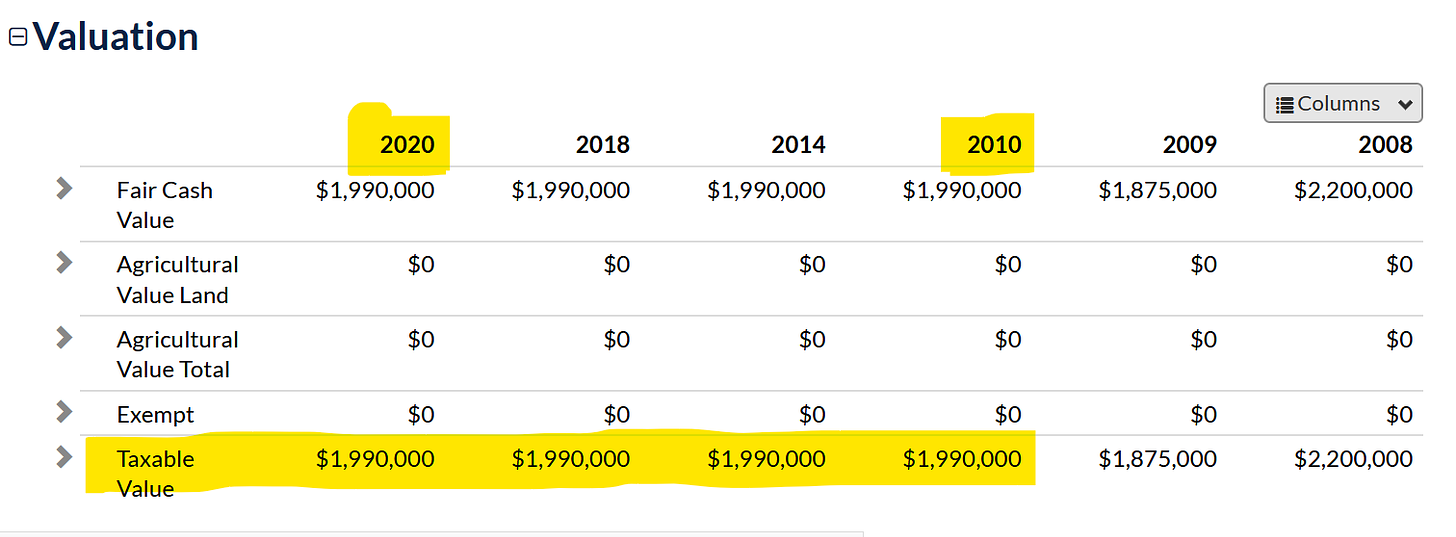

Examination of the Calipari’s property tax assessments from 2010 to 2024 shows that PVA O’Neill’s team broke Kentucky Department of Revenue protocols for UK’s head boys basketball coach starting around 2013 or 2014. If you are wondering, in each of these years that O’Neill chose not to assess, Calipari signed a new contract with UK based off what would ultimately be a fleeting few years of success in the annual springtime boys national basketball tournament. In 2013, the new contract paid the head boys ball coach at least $5.2 million per year. A year later, 2014, the second new contract netted Coach Cal $7.5 million per year.

Four years later, O’Neill’s PVA would again break the state’s own protocols and again not assess Coach Calipari’s home. This skipped assessment occurred sometime around 2018 or 2019, which is also when John Calipari signed yet another new contract with UK, this one a lifetime deal (thank God!), for approximately $8.6 million per year.

During this decade of Calipari’s continued contract renegotiation, UK experienced a post-recession housing boom that was fueled by low-interest rates and a shortage of housing. Here is PVA David O’Neill saying the same thing this past year in Smiley Pete:

Housing prices are about supply and demand. Limited availability of land and labor have conspired to limit the supply of new houses coming online each year, and low interest rates have helped support an already strong demand. The number of new homes built has hovered near 500 per year, with slight fluctuations over the past decade. In the calendar year 2021, the median sale price for a newly constructed house was almost $370,000 — more than $100,000 higher than for existing stock.

And here is O’Neill again on Lexington’s super-sized, decades-long, increase in housing prices. Essentially, O’Neill acknowledges two separate housing booms that were stacked on top of each other—the post-Great Recession boom from 2014-2020, and then the post-2020 Covid boom:

The increase was sharper over the past two years, but the gains are not a recent phenomenon. They have risen consistently since the recovery from the recession began in 2012, when the median sale price was $146,000, compared to $260,000 today. That’s an increase of nearly 80 percent in 10 years. [Emhasis mine.]

Helpfully, O’Neill includes a graph.

The Long View

If anything, the Calipari’s in-town neighborhood of large homes with spacious half-acre yards experienced this extended housing price boom most acutely. And yet, despite even the PVA’s acknowledgement, the 2020 tax assessment for John Calipari’s in-town 6 bed, 8 bath, 9500 square foot house with newly attached pool, tennis court and pool house had not increased one cent in assessed tax value across 11 years.

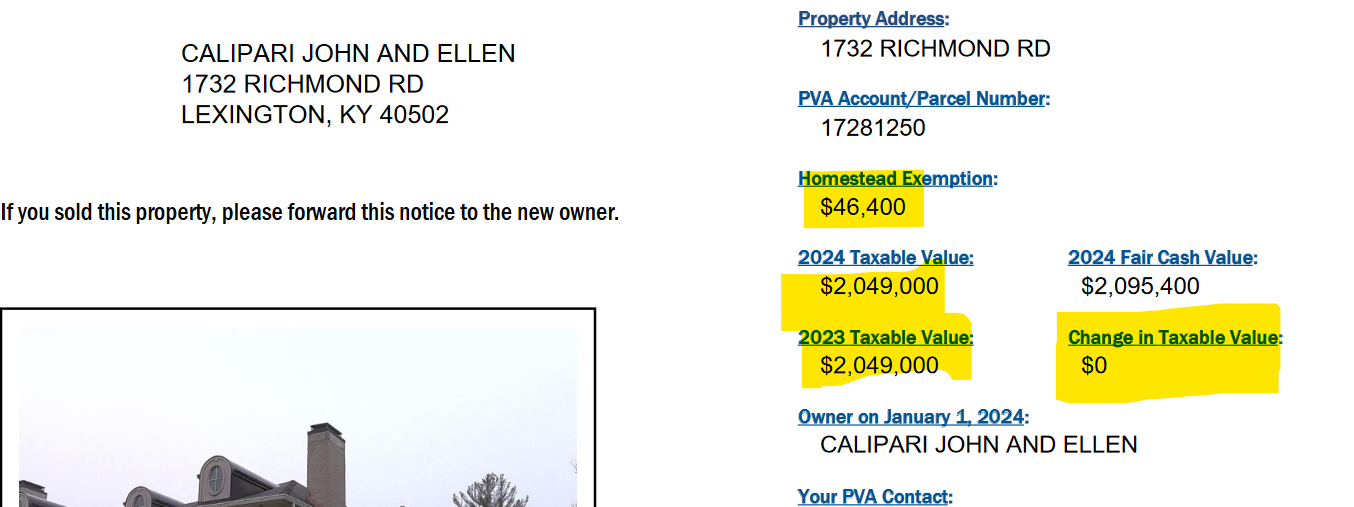

O’Neill’s first actual assessment of the 9,500 square foot Calipari homestead occurred in 2021, the city’s first Covid tax assessment. (And for those keeping score, also a historically poor year for UK boys basketball.) While PVA O’Neill was acknowledging sharp 30% increases in home values over the previous 4 years, and a county-wide 80% increase across 10 years, Calipari’s home appears as an exception to the exceptional increases. For the head boys ball coach, the assessment increased a relatively paltry $105,400, or 5.3%.

By happenstance, we’re sure, 2021 was also the first year that Coach Calipari was eligible for the old-people homesteader exemption. (Would that this old-people exemption applied on the hardcourt, too.) The homestead exemption meant that Calipari’s 2021 assessment only accounted for a $64,900, or 3.2%, increase in the multi-millionaire’s home value.

If you are wondering, the PVA decided to leave the 2024 Calipari assessment unchanged.

Here’s the long view for assessing John Calipari’s 9,500 square foot Lexington property asset.

After the addition of a new pool, pool house, pool patio and tennis court, the Fayette County PVA assessed the Calipari home a fair cash value of $104,600 less than it was valued in 2008, the year before Calipari purchased it.

Now that’s some crazy shit. For me and you, home values increased 80%, even by our county PVA’s standards, whether we added a pool house or not. For John Calipari, though, the value went down 4.8%!

Generally, we believe in our government when it appears to operate fairly and without favor. Without fairness, though, we might as well operate in an oligarchy. Such societies compel a certain superficial public obedience, but they do so at a cost of deeper community cohesion.

Beneath the surface, privately, nobody in their right mind living in an oligarchy takes seriously the preening statements emanating from the mouths of our elected and unelected leaders. Those deeply believing people are usually either oligarchs themselves, company snitches, or high lonesome strivers.

Howard Stovall

Did Calipari not also purchase the adjoining empty lot? Is that included?

Danny Mayer

He did buy the adjoining .61 acre empty lot at the same time for $425,000. I did not include that lot in my writing, but it has not been re-assessed since 2005.