In September 2010 Southland Christian Church of Lexington purchased the vacant mall property at 2349 Richmond Road for $8,132,000, from previous owner Saul Holdings Limited Partnership, a subsidiary of Saul Centers, Inc., a Real Estate Investment Trust specializing in large commercial properties. Over the next two years the church razed the decaying mall and constructed a new campus, across the parking lot from a Home Depot, and abutting the city-owned Lexington Senior Center and Idle Hour Park.

At the time the sale was announced, Andrew Battista wrote an excellent critique of the transaction and what he perceived to be the theologically dubious underpinnings of the mega-church movement in the United States. Here I’d like to revisit his subject, but this time with a focus on the Southland’s exclusion of women from its governance and the propriety of granting tax exemptions to an organization that practices such discrimination.

First, a reexamination of land value and taxation: the Richmond Road property is slightly larger than 23 acres, zoned commercial, and is currently assessed by the Fayette Property Value Administrator at a value of $7 million. This represents a considerable decline in assessed value over the last 20 years; in 2001, when the old mall still claimed a handful of operating retail stores, the site was valued at $14 million. Prior to that, when Saul Centers purchased the property in 1993, they paid $17 million.

The current valuation makes sense in the context of what the property had become since 2005, when the sole remaining tenant, Dillard’s, finally closed shop. The abandoned mall had become, as then-Councilmember Cheryl Feigel called it at the time of the sale to Southland, an “eyesore,” and the state of the place surely had a depressing effect on the westerly properties along Richmond Road. Since the sale, much of that stretch of Richmond Road inside New Circle has undergone significant remodeling, and is now much more “upscale” in appearance than it was a decade ago. In fact Saul Centers had claimed, throughout the 2000s, such depreciation on its money-losing property that it recognized a gain of $3.6 million on the sale to Southland, despite recouping less than half of what they paid in 1993.

So in that sense the assessment of $7 million seems fair. However, in the context of the neighborhood as it exists now, that figure may be selling the potential value, were it a functioning, tax-generating commercial property, rather short. For comparison, the Home Depot lot next door to the church campus is 15 acres (eight fewer than Southland’s) and is assessed at $7,873,000. And behind the Home Depot and Southland lots sits the 23-acre Lexington Senior Center/Idle Hour Park lot, which last year was valued by the PVA at more than $12 million. One must presume, then, that if the Southland lot contained a big-box retailer or car dealership (the James Motor Company across the street sits on 4.1 acres, assessed at $5.6 million) the fair cash value of those 23 church-owned acres would be considerably more—likely north of $10 million.

The obvious objection here is that since churches are exempt from paying property taxes, it doesn’t really matter how the PVA assesses 2349 Richmond Road. They could value it at $7 million or $70 million, and the tax bill would still be $0.00. But it’s still instructive to calculate how much tax revenue is lost, at the current tax rate of 1.2777 percent, by Southland’s ownership of such a large, well located commercial property.

- First, if we accept the current assessed value of $7 million, a tax-paying property owner would provide revenue to the city of almost $90,000 annually.

- If the church property were valued at least as much as the adjacent Home Depot, it would provide revenue of around $100,000.

- If the church property were valued as much as the similarly sized Senior Center/Idle Hour Park lot, it would provide revenue of more than $150,000.

Of course even $150,000 is less than one percent of Lexington’s projected 2020 realty tax revenue of $22,729,000, and one might thus object to the implication that the city is losing any great amount of general-fund dollars by Southland’s ownership of the Richmond Road lot. (Jessamine County, on the other hand, with property-tax revenue of only $2.5 million, may be losing quite a lot on Southland’s massive Harrodsburg Road complex). Still, as Lexington looks to slash its budget deficit by cutting city services. it can feel frustrating to leave any potential revenue on the table.

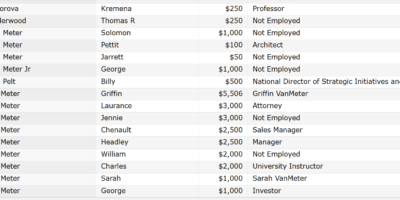

Especially since it’s apparent that Southland can afford to pay it. The church’s financial statements are not available to the public, but Kurt Braun, the Executive Pastor Of Operations/Advancement, was kind enough to respond to my query about Southland’s annual income, almost all of which comes from donations from its congregants, who number upward of 10,000, according to the church’s Wikipedia page. Mr. Braun placed the church’s total received donations in 2019 at approximately $19 million, and projected about $20 million for 2020.

That of course seems like quite a lot of money, but given the size of the congregation, it makes sense. The church recommends its members tithe, as is customary for U.S. congregations, but it seems unlikely that all do so, so I’ll use a conservative estimate and speculate that only a third of Southland’s active members donate 10% of their annual incomes—although certain wealthier members likely donate considerably more, and others may provide large, one-time bequests.

That’s 3,333 tithing church members, of whom we’ll estimate that three-quarters are Fayette County residents, and that the remainder are split between Jessamine and Boyle Counties, where Southland’s other two primary locations are situated. The per capita annual income of Fayette residents is around $50,000, and thus we can guess that 2,500 (3/4 of 3,333) Southland members give $5,000 annually, for a total of $12,575,000. Per capita incomes in Boyle and Jessamine Counties are just shy of $38,000 and $44,000, respectively, so if we average those figures, then 833 church members are giving $4,100 annually, for a total of $3,415,300. Added to the Fayette County donations, that’s more than $16 million in annual donation revenue.

So $20 million isn’t outrageous for a church of Southland’s size. On the other hand, it is, in fact, quite a lot of money—enough, as was demonstrated, to buy a shopping mall, raze it, and construct a gleaming new campus in its place. One might assume that a property tax bill in the $100K range, then, wouldn’t be much of a hardship for the church, were it legally required to pay it.

But should churches pay taxes? The argument that they should has been made more eloquently than I’m able to here, and so has the contrary position. While in general I do gravitate toward the former position on establishment-clause grounds, what I find particularly objectionable in this case is the granting of tax exemptions to organizations that discriminate on the basis of gender, as Southland does.

As the their bylaws plainly state, the church excludes women from serving on the 12-member Board of Elders, its primary governing body; specifically, Section 2.2 restricts those positions to “any active male member of the Church who has been a member for at least one year.” Women, it should be noted, are welcome to perform various upper-level administrative duties, and many do, but the Elders, the Chairman, Vice-Chairman, Secretary, and Treasurer of which are also the legal officers of the corporation, are men-only.

While again there is a strong case that all non-profit organizations, even those as wealthy as Southland, should be tax-exempt, I find it hard to reconcile the granting of privileged financial status with overt and ongoing gender bias. The law carves out an exemption for religious organizations from anti-discrimination statutes, which makes sense if one accepts that government should not be allowed to dictate the terms of religious practice, which is surely a founding principle of our nation.

However, while the government rightly cannot force Southland to allow women to serve on its governing body, unlike what would be the case for non-exempt employers, I find the church’s discriminatory practice distasteful on two grounds. First, in our times, in 2020, I feel the church should want to allow women on its Board of Elders, if for no other reason than to reject the biases of the past and to join those of us who prefer to live in a more enlightened present and future. It’s reasonable to assume that there are those within the church hierarchy who do feel this way as well, but have been unable to make that change. In that case, one should feel sorry for the blinkered, closed-off souls who have been successful in denying it.

Second, it’s irksome to consider that Lexington taxpayers should, indirectly, be compelled to make up for the revenue shortfall, relatively insignificant as it may be, created by Southland’s ownership of the old mall property. In a sense, we must provide what the church (and, to be fair, all churches) does not; this fact by itself wouldn’t be especially bothersome, but the policy of gender discrimination makes it so. It’s the having it both ways: if Southland insists on maintaining its male-only leadership, as is their constitutional right, should they also be allowed to avoid taxation?

More than the tax money, of course, I’d like to see Southland make a change in its by-laws. Perhaps with time the church’s leadership will see their way clear—see the light, as it were—to do just that.

Leave a Reply