News broke over the holiday weekend that the home of former University of Kentucky head boys basketball coach John Calipari had sold for $3.4 million. This amount, Herald Leader writer Janet Patton was quick to note in the lede to her story, was “about a half million under the list price.”

I have been tracking the Calipari estate since it was listed for sale in April. Writers at the Herald Leader and elsewhere who covered the story have focused on the $4 million listing price, which was arrived at through a private appraisal. A typical story on the Calipari estate featured verbiage like this, from Patton in early May:

Drake [the listing agent] said that the house had appraised for much more but that Coach Cal decided to list for under the appraisal price. ‘He said they have loved it here and hope a family will love it as much as they have, and love the amenities of it,’ Drake said. ‘That’s more important to him …That’s his heart.’

So sweet. From his heart. Gotta love him, that Coach Cal.

But for residents of Lexington, the important appraisal figure is the one produced by the Fayette County Property Value Administrator, an elected position held for over a decade by Democrat David O’Neill.

The PVA’s appraisal, commonly known as an assessment, determines the annual amount that the Calipari’s contribute in property taxes. This is the number we should look to, if we were want to interpret appraisal figures, as the best representation of the Calipari’s sweet, civic, family-loving, tax-paying proletarian hearts, as it were.

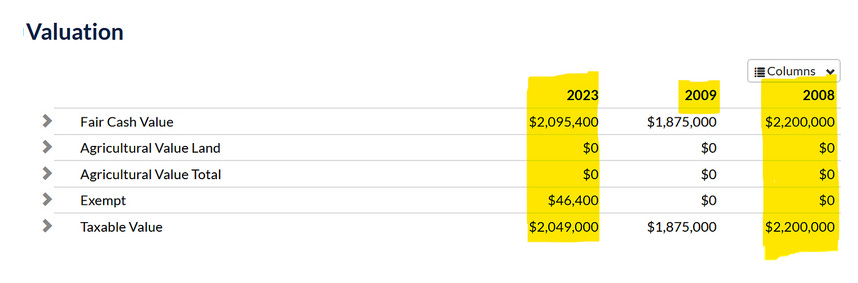

Early in my research on the listing, I came across something pretty astounding about the Calipari tax assessment. Across fifteen years and two housing bubbles, the Calipari estate had experienced a stunning drop in assessed tax value. This drop in taxable value occurred despite the Calipari’s building a pool, a pool house, and tennis courts upon it as soon as they purchased it in 2009.

The stagnant Calipari assessments seemingly defied the trends produced by two separate housing bubbles (post-Recession and post-Covid), which saw home values spike across the nation, Lexington-Fayette Urban County (LFUC) included. These property spikes ultimately led most LFUC homeowners to experience significant increases in their own home’s tax assessment.

Here is a common headline for the era:

Now that the Calipari home has sold, we have price discovery. We can definitively state that, in addition to coming $500,000 under the real estate listing price, the $3.4 million purchase was also about $900,000 greater than the home’s tax valuation. The Calipari’s may have sold for $3.4 million, but they were only taxed at a $2.5 million value. Fayette County Property Value administrator David O’Neill had under-assessed the Calipari homestead by about 35%.

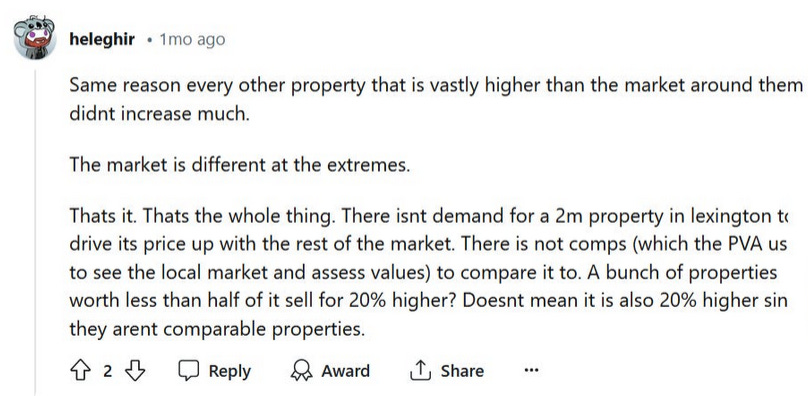

In my initial reporting, some readers felt that I may have been too harsh on the poor (or crony) assessment capabilities of PVA O’Neill, who has overseen most of the Calipari’s 15 years of lowball tax valuations. In my response to some of these comments, I broadly labeled this group the nothing to see here crowd.

Nothing to see here members expressed some or all of three broad claims:

- Not enough crazy rich people live in LFUC to purchase a multi-million dollar home, which has had the practical effect of capping the Calipari home value at $2.5 million (for 15 years).

- Increases in real estate value have been driven by mid-level property buyers, not the ultra wealthy. Consequently, only mid-level LFUC homeowners are likely to have experienced the increase in property evaluations that even PVA O’Neill has admitted was occurring in most Lexington neighborhoods.

- The Calipari’s were not the only people whose property values stayed relatively the same for a couple of decades. Many LFUC homeowners long held under-assessed properties. As wealthy and publicly influential residents, the Calipari’s were therefore not singled out for protection by PVA O’Neill.

While some of the arguments have merit around the edges, I am not sure that the nothing to see here views broadly hold up in this instance to price discovery.

First off, the Calipari homestead was bought by the owners of a local home improvement company, the Painted Horse, who have a storefront on Richmond Road. These seemingly small business owners are successful, yes, but nothing like being the head of a major D-1 boys basketball team. And yet, they could pony up the $3.5 million purchase price for the estate.

How many Painted Horse-level wealthy live in Lexington? I’m going with quite a bit. A market’s worth. Enough for the PVA to provide reasonable assessments in line with the rest of us FUCers, whose property values (like Calipari’s) went up over the past decade of price increases.

Meanwhile, as the recent home purchase of UK’s newest head boys basketball coach demonstrates, Calipari is, yes, not the only person in this community to get the seeming A-#1 treatment by PVA chief David O’Neill. This week, it was reported that new boys head basketball coach Mark Pope bought a 10 acre gated mini-estate nearby the Lexington Country Club.

Pope purchased the estate for $4.75 million.

The property had just been assessed, in 2024 for FUC’s sake, by the O’Neill team for…$2.6 million. Who were these people who were given such a low assessment by O’Neill? Who knows. They were just the ordinary ol’ kind with the money to purchase a 10-acre allotment within a gated community that sits next to the Lexington Country Club.

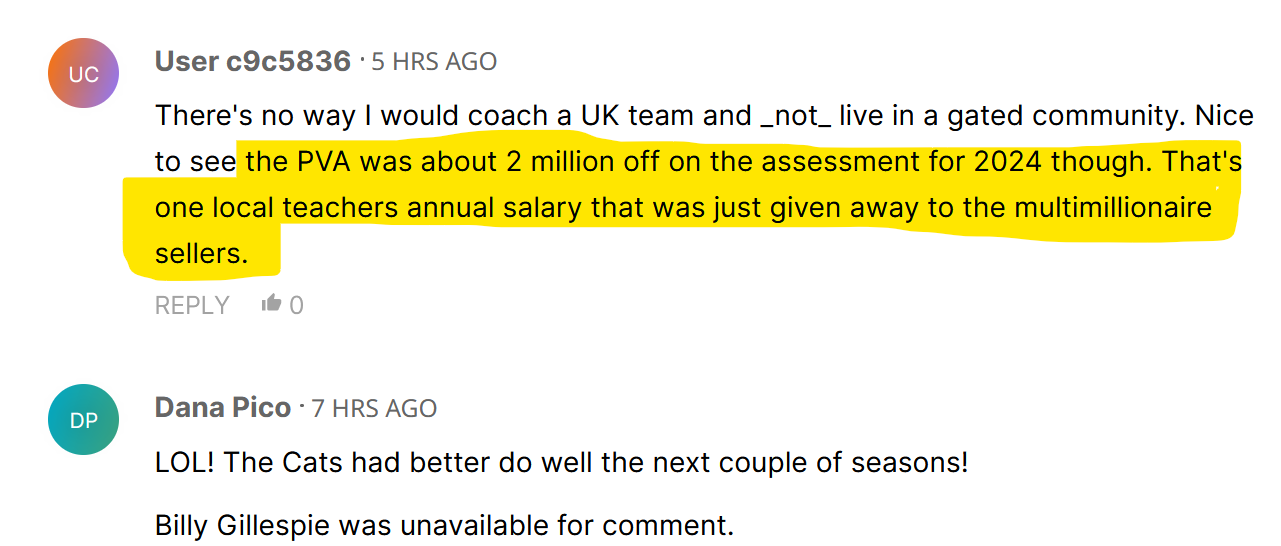

When you are publicly off by $2.15 million on your tax evaluations—80% under assessed!—it should really cause the public to voice some concerns (or at least do public reporting) about your work. But don’t just take it from me. Here’s a Herald Leader commenter on the O’Neill flub:

Nice to see the PVA was about 2 million off on the assessment for 2024 though. That’s one local teachers annual salary that was just given away to the multimillionaire sellers.

Sooner or later, one would hope that reader comments get reflected in the reality reported on by our official media betters—moving from the folk commentary of, say, User c9c5836, to the bonified on-record journalism of a Janet Patton or a John Cheves, as it were.

Our public concern as residents should be that, for quite some time now, O’Neill seems to have been giving a certain swath of owners better tax deals by way of artificially low assessments. I doubt that the misses are flubs, so much as they demonstrate a certain managed dipshit neglect that tends to (haha) most benefit the already-benefited, and which seems to get scrubbed over by our community of civic leaders and reporters.

As User c9c5836 suggests, lowball assessments have real world implications. More on those real world implications later.

zaphod

O’Neill has said that the fair cash value assessment is an automated process that looks at a handful of recent sales of comparable lots (DevelopLex podcast, ep 47). It does look like this system might be too conservative on the high end of the market because of lack of data (or cronyism, as you suggest).

The sale of the Calipari estate was the largest sale of single family home sold in the previous 6 months in Fayette County. There were only 4 sales above $2 million in that same time. All of them were under-appraised at the time of sale, although one of was an “expansion sale”, and I’m not quite sure what that means.

Interestingly, another one of them (1616 Tates Creek Rd, Unit 6, in McMeekin place) had previously sold for below the appraised value in 2021 ($1.175 M vs $1.433 M appraised value from 2016). Then just 3 years later it sold for $2.7 M.

None of those $2 M+ sales were what the PVA system considered the most comparable sales. The most comparable sales listed on the PVA website were all for much less:

– 2117 Shelton Rd ($1.015 M, 2022)

– 1912 Lake’s Edge Dr ($1.9 M, 2019)

– 4835 Faulkirk Ln ($1.24 M, 2022)

– 767 Lakeshore Dr ($1.7 M, 2023)

– 2089 Lakeshore PL ($1.7M, 2021)

It would be interesting to do a statistical analysis of all recent high-end sales and their appraised values prior to the sale to see if there if the PVA is consistently leaving money on the table.

zaphod

> The sale of the Calipari estate was the largest sale of single family home sold in the previous 6 months in Fayette County.

Ugh, what a disaster of a sentence. Hopefully it’s still comprehendable.

Also, the PVA office only reassesses a portion of the properties in the county each year. So properties may go a few years before being reappraised. It would probably be more accurate to reassess every year instead of making huge jumps every 4 or so.

zaphod

I apologize, you already noted the 4 year cycle and the problems surrounding it in the previous piece.

Danny Mayer

Heh…I’m an expert in making word salad. I got the meaning.

To me, 35% is a lot at that high price point. Particularly because the place was virtually un-assessed for 15 years. 30% on a 200k house is one thing. That’s $60,000. But for Calipari, 30% is close to $900,000 under-assessed. In the case of the .6 acre empty lot (on PVA records, at least), it was last assessed before the Kerry/Bush campaign, if I recall. And this in a city that supposedly has an Urban Service Boundary which prices in town acreage at an increasing premium.

I focus on Calipari, but I don’t think the PVA favored him specifically. The Pope sale is a good example. And O’Neill has a history of under-assessing high-value Fayette properties, This one’s Jim Gray’s place, but there was also a Webb property that sold to the LFUC school system:

https://www.kentucky.com/news/local/counties/fayette-county/article260869977.html