CP docs provide concrete costs to opaque TIF contracts and the civic process for enacting them

Never heard of a TIF? No worries. TIFs are among a variety of localized public/private transactions that may also circulate in your town. Industrial Revenue Bonds (IRBs), Tax Allocation Districts (TADs), Community Development Block Grants (CDBGs), Opportunity Zones. A TIF is among the many genetic variants of financial dark matter that circulate the world over.

This post will employ Lexington’s CentrePointe documents to explain what TIFs are and how they work. It will answer questions like, Can I get my own TIF to finance my home addition/office expansion?, and What is the difference between a baseline tax and a tax increment?

TIFs & TIF zones

TIF is shorthand for tax increment financing. As enshrined in Kentucky Revised Statues (KRS) Chapter 65, tax increment financing is an “economic development tool used by public agencies to finance needed infrastructure improvements for a project by earmarking future tax gains [ie, tax increments] resulting from the development for the improvement.”

In areas designated as Tax Increment Financing (TIF) zones, developers receive up to 80% of city and state “tax increments” as repayment for building any infrastructure upgrades that surround their development, normally for a period of 20-30 years. In the CentrePointe TIF Zone, a 30-year TIF, the built public infrastructure was a 700-space underground parking garage to store the cars of the patrons of the Webb Companies’ CentrePointe tenants, who currently include Residence Inn by Marriott, the Lexington Marriott City Center and Jeff Ruby’s Steakhouse.

Public infrastructure in the CentrePointe TIF zone.

I know what you are thinking. Honey! Let’s make us a TIF zone and build that three-story car-port with attached five-story underground bug-out bunker that we’ve always dreamed of!

Not so fast. To ensure that not everyone gets this kind of deal–seriously, can you imagine the chaos to ensue if we all could petition local government to keep 80% of the tax increments generated around us!–TIFs operate through various restrictions on citizen access.

The primary TIF restriction is of course money. In 2013 when the CentrePointe TIF was signed into law, the minimum threshold for potential citizen recipients was a $10 million investment. This was for a standard TIF. Like the UK “K” Club, TIFs have levels. CentrePointe’s TIF level was, no joke, the “Signature” level.

CentrePointe TIF is a Signature Project. Source.

In 2008 when the CentrePointe TIF was first approved, the minimum threshold for a Signature project was $200 million. Developers had to spend $200 million on their investment before receiving any public tax increments. By 2013 when the CP project was re-approved, the Signature threshold had been cut to $150 million.

For the handful of people with the assets to plan a $10 or $150 million project in the Commonwealth, there is a second limiting TIF restriction. This one concerns project placement. Can you imagine the chaos if neighborhoods across Lexington began to pool resources to establish a TIF where they could recoup up to 80% of the tax increments produced there? Or if multiple private developers were to claim TIF ownership over the same area, like shingles on the frontier of yore?

TIF laws ward off geographic anarchy by specifying both the general territory and specific zones in which millionaire Developer X may assume rights to up to 80% of city and state tax increments. When the the CentrePointe project was first approved, TIFs were mostly understood as urban tools for upgrading the Hood or abandoned post-industrial brownfields. As such, TIF zones were originally limited to “distressed or underdeveloped areas where private development would not otherwise occur.”

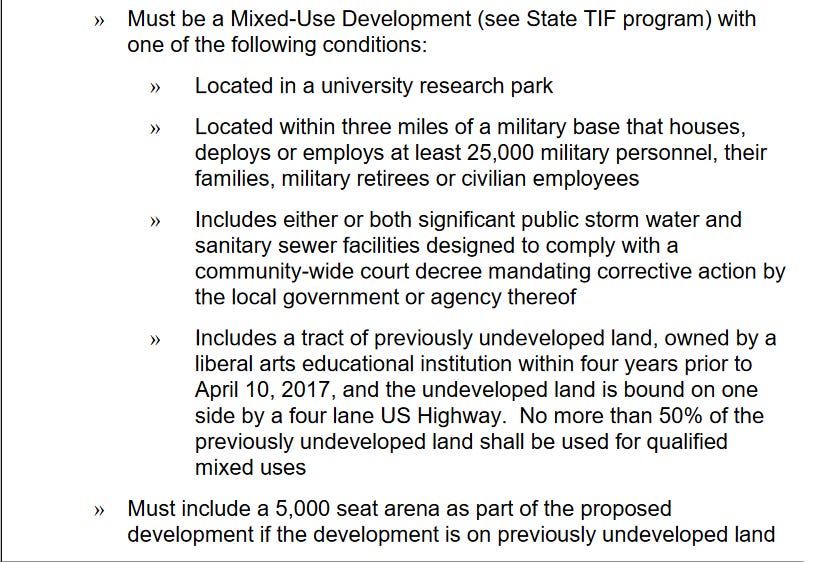

Subsequent updates to Commonwealth TIF law since 2008 have expanded available TIF territory. Currently, TIF zones may also appear in a university research park, within three miles of major military bases, anywhere in the Commonwealth where water quality issues may arise, across the entire West End of Louisville, and upon “a tract of previously undeveloped land, owned by a liberal arts educational institution within four years prior to April 10, 2017”—this last TIF territory available only so long as “the undeveloped land is bound on oneside by a four lane US Highway [and n]o more than 50% of the previously undeveloped land shall be used for qualified mixed uses.”

From Kentucky Cabinet for Economic Development’s “Just the Facts: Tax Increment Financing (TIF)” explainer for a “Blighted Urban Redevelopment Area” TIF, updated July 2022

CentrePointe’s TIF zone, set in lovely downtown Lexington, winner of many travel and relocation awards from smart national publications, is neither distressed nor undeveloped urban land, though it does appear on census maps adjacent to pockets of urban poverty and environmental decay.

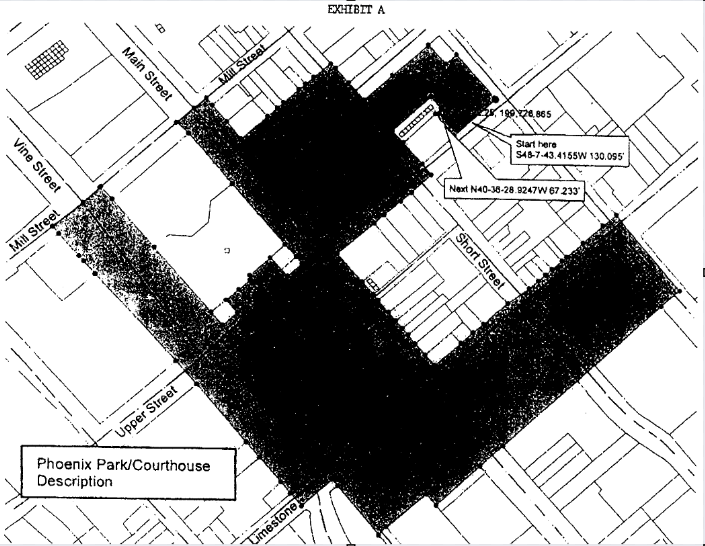

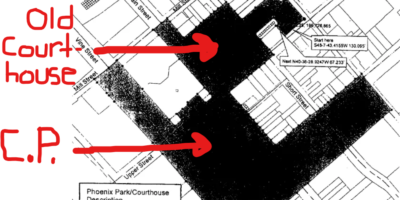

The TIF zone runs along both sides of Main. Its farthest edges rest against the former site of the stockade walls for the original 1775 Fort Lexington, which had once protected forlorn new arrivals from native attack. Far from marginal and disinvested, the CP TIF resides at the very center of city development.

Baseline & Incremental Taxes

Once the zone of development is determined, tax increment financing relies upon a series of before>after splits that divert public money to the private TIF developer. The first split appears at the “baseline” tax for the TIF zone.

Baseline taxes represent the total amount of taxes collected within the zone for the year previous to TIF development. In theory, the Baseline amount represents a way to track the crappy and under-performing “status quo” approach to the TIF zone. A future where no new development occurs and dumb trolls roam the earth. In the CentrePointe TIF, this Baseline year was 2008 and amounted to somewhere around $40,000 in local taxes for the entire 3 acres.

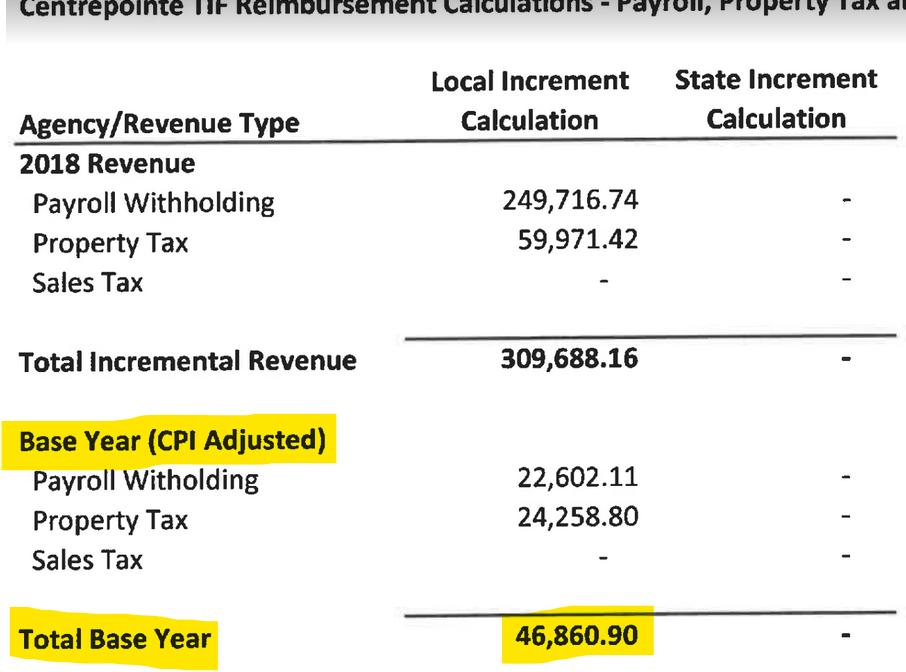

The Baseline also represents the tax amount within a TIF zone that continues to be 100% owned by the public. Because it is pegged to inflation, this amount marginally increases each year. In 2018, the year CentrePointe hit its $150 million “Signature” threshold and began to receive city and state tax increments, the local Baseline amount was $46, 860.

By 2022, the last year for which NoC has documents, the local Baseline amount had increased to $57,264.

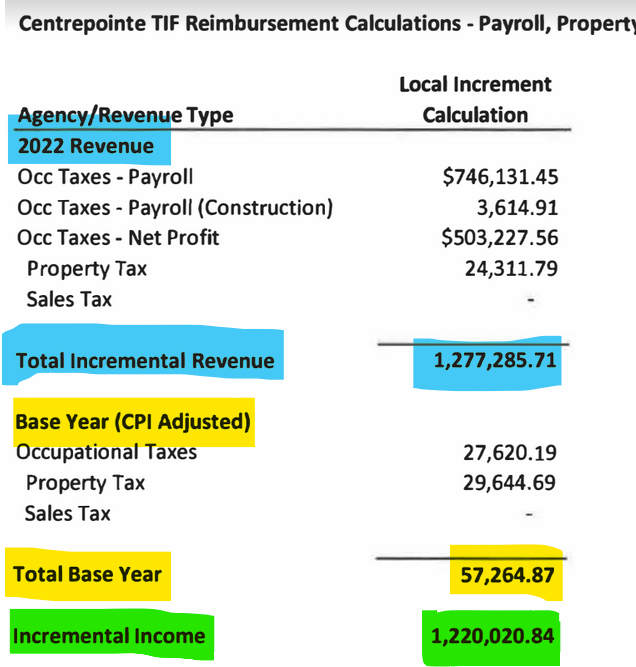

In 2022, the CP TIF zone generated $1.277 million in local taxes (blue). The Baseline taxes were pegged at $57,200 (yellow). To get the Tax Increment (green), city staff subtract Yellow (Baseline) from Blue (Total).

Unlike Baseline taxes, “incremental” taxes represent a shared revenue stream in which the public is a minority stakeholder. In theory, a Tax Increment measures the annual value added by TIF zone development. In CentrePointe’s case, this is the value delivered to the Zone by Centrepointe Parking Services’ 700-car underground garage.

To determine the Tax Increment for a particular year, Lexington officials subtract the adjusted Baseline (pre-development “Status Quo”) tax amount from the total taxes generated within the zone for that year.

In 2018, the CP TIF Zone generated a total of $309,688 in local taxes. Its Baseline amount for that year was $46,860. Subtract the Baseline from the Total—and then take out a bit more for administrative vigorish—and you arrive at a 2018 Tax Increment of $157,827.

2018 Total Tax (blue), Baseline Tax (yellow) and Tax Increment (green) for CentrePointe TIF

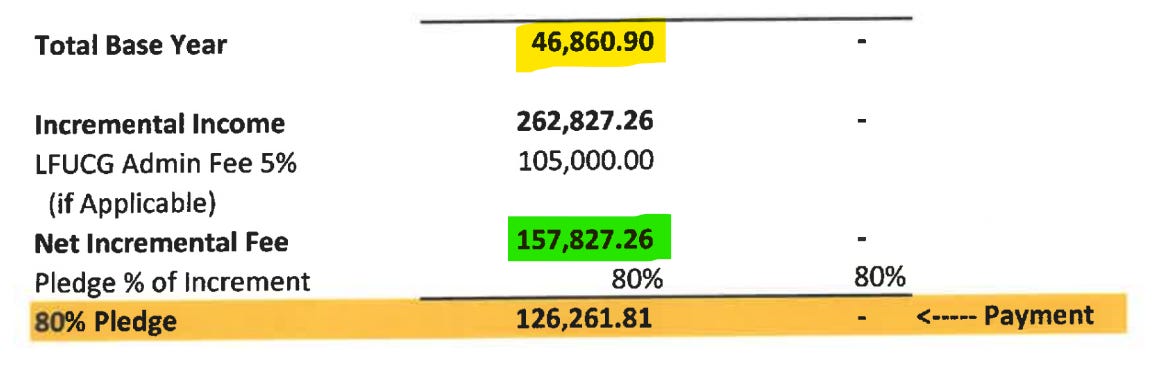

A second revenue split occurs within incremental taxes. The CentrePointe TIF is typical in directing twenty percent of its Tax Increments to you, the public. It then directs the other eighty percent of annual Tax Increments to the Centerpointe Parking Service, LLC, for a period of 30 years.

Of the $157,827 in 2018 Tax Increments generated within the CentrePointe TIF zone, $126,261 (80%) went to Centrepointe Parking Service, LLC.

In 2018, Centrepointe Parking Services claimed $126,261 in Tax Increments generated within the CentrePointe TIF zone.

There is a different way to report the tax increment, one that affirmatively documents the public’s portion of the Tax Increment.

In the same year, the public’s portion of the $157,827 CP Tax Increment was….$31,565. To this amount, Lexington residents also received the 2018 Baseline tax. In sum, then, the public received $78,425 in local taxes from the $309,688 total generated within the CenterPointe TIF zone in 2022.

$78,425 is what went into the public till for things like police officers, parks maintenance, trash pickup, sewage safety, affordable housing, libraries, and other city services and infrastructure. It did not even match the $105,000 in 2018 administrative vig charged to service the CP TIF itself.

You may remember the tax year 2018. In Lexington, the CentrePointe project had yet to finish; its tenants and their customers yet to arrive. The real CentrePointe project payouts—and the tax increment growth to follow—lay on the horizon.

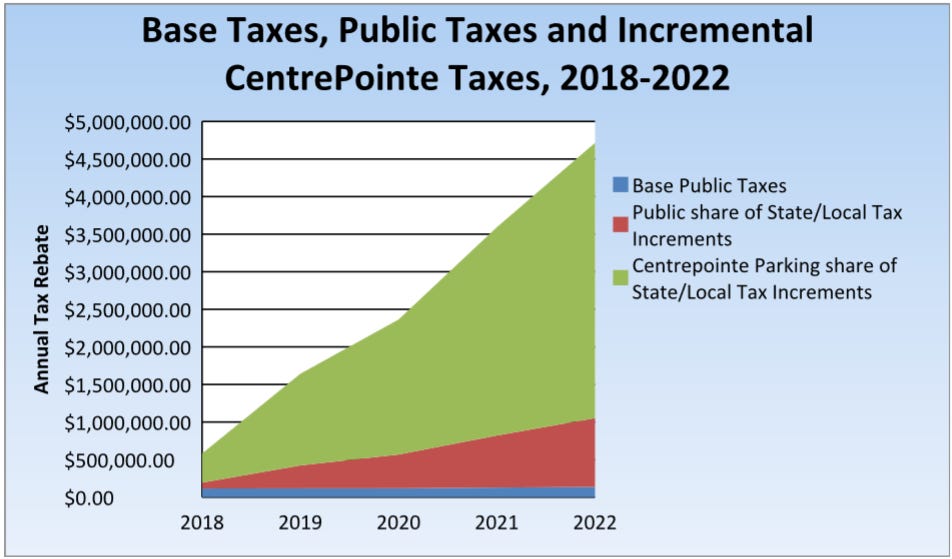

In future posts, I’ll get into some of the figures for the CP TIF zone’s later years. In the meantime, here’s a graph of where things head.

2 Pingbacks