Thank former Mayor Jim Gray for the TIF arrangement

This is Part 3 of my ongoing reporting of the CentrePointe Tax Increment Financing development project. Articles in this series include:

Part 1: The CentrePointe TIF matures

Part 2: How TIFs work

***

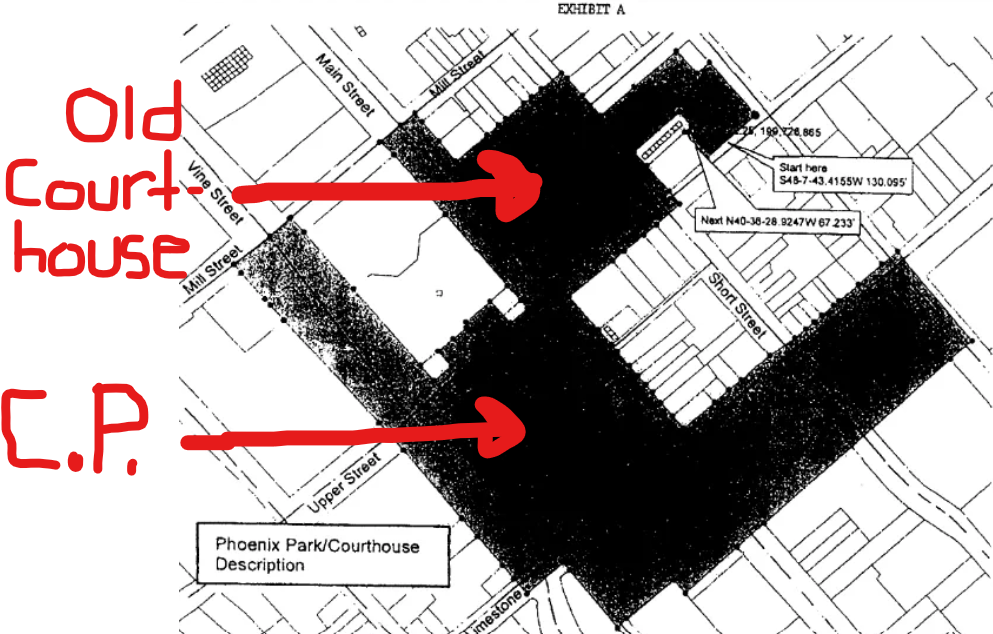

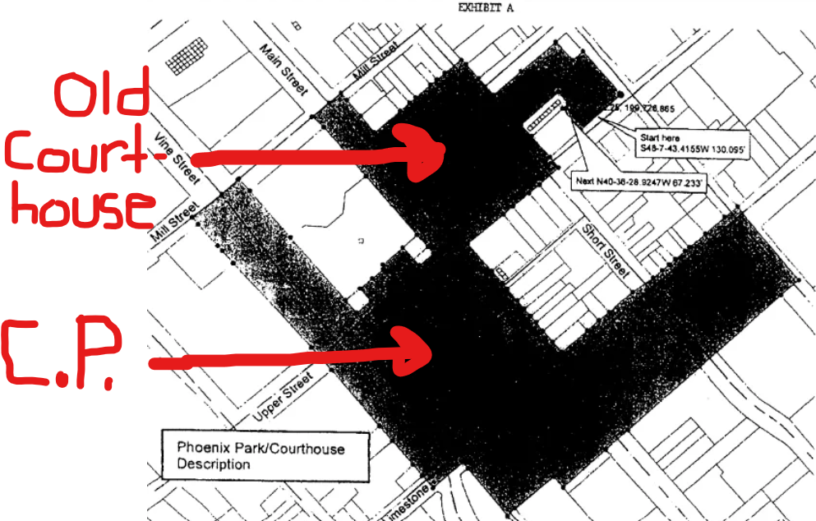

The CentrePointe (City Center) and Old Courthouse development projects are generally understood as separate entities. The former is a private development high rise located on a historic downtown city block that was razed for the project. The latter is a public renovation of a nineteenth century Richardson Romanesque structure that anchors the city’s central town square, what one local writer has called “one of downtown Lexington’s most iconic and recognizable buildings.”

However, the two projects are directly linked in at least one significant way. The Old Courthouse sits within the CentrePointe Tax Increment Financing (TIF) zone, voted into existence in 2014 under the Jim Gray administration.

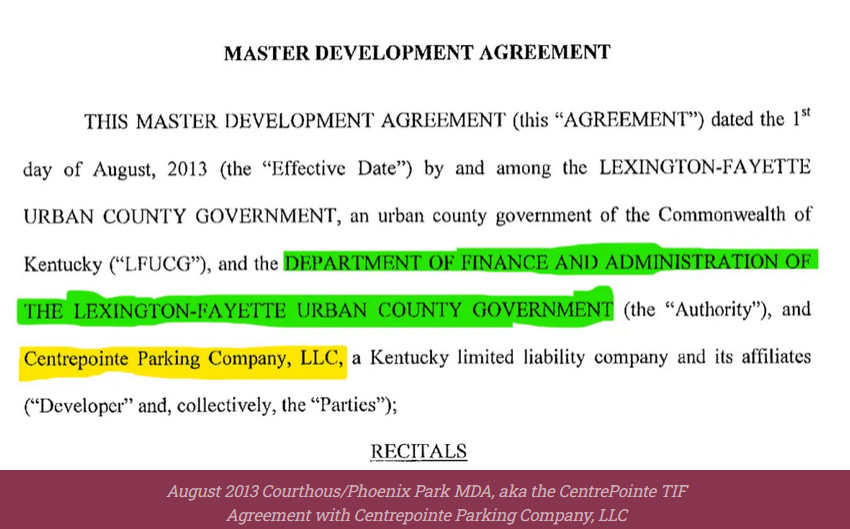

Under terms of the CentrePointe Master Development Agreement, nearly all local and state taxes generated within the CentrePointe TIF zone get paid to CentrePointe Parking Company, LLC. These annual tax transfers are made as government payment for a private three story underground parking garage, run by CentrePointe Parking Company, LLC, that serves the (now renamed) City Center development and its two mid-rise hotels.

The votes to subsidize both the CenterPointe and Old Courthouse projects took place within months of each other in 2014. Nobody seems to have noted this on record (including our class of local journalists), but in the case of the $32 million public investment to renovate the Old Courthouse, officials and elected representatives and at least some others were likely aware of a few key interlocking features.

These included:

- Publicly footing the significant costs for renovating the publicly-owned Old Courthouse building, which had virtually no previous tax footprint;

- then renting the renovated building out to upscale tenants like the Ouita Michel-owned Zim’s Cafe and her bar concept, the Thirsty Fox,

- establishments that rely upon the subsidized hotels built from the CentrePointe TIF to supply them with enough high-end customers to make their business concepts work;

- only to have most of the taxes generated from unleashing all this high-end new Old Courthouse business activity get paid out to the dudes at CentrePointe Parking Company, LLC, for their private underground parking garage.

- For a period of about 25 years.

It is unknown just how much in annual local and state tax revenue that CentrePointe Parking Company, LLC has thus far received from the Old Courthouse development. FOI requests did not return tax information specific to the individual businesses that fall within the CP TIF.

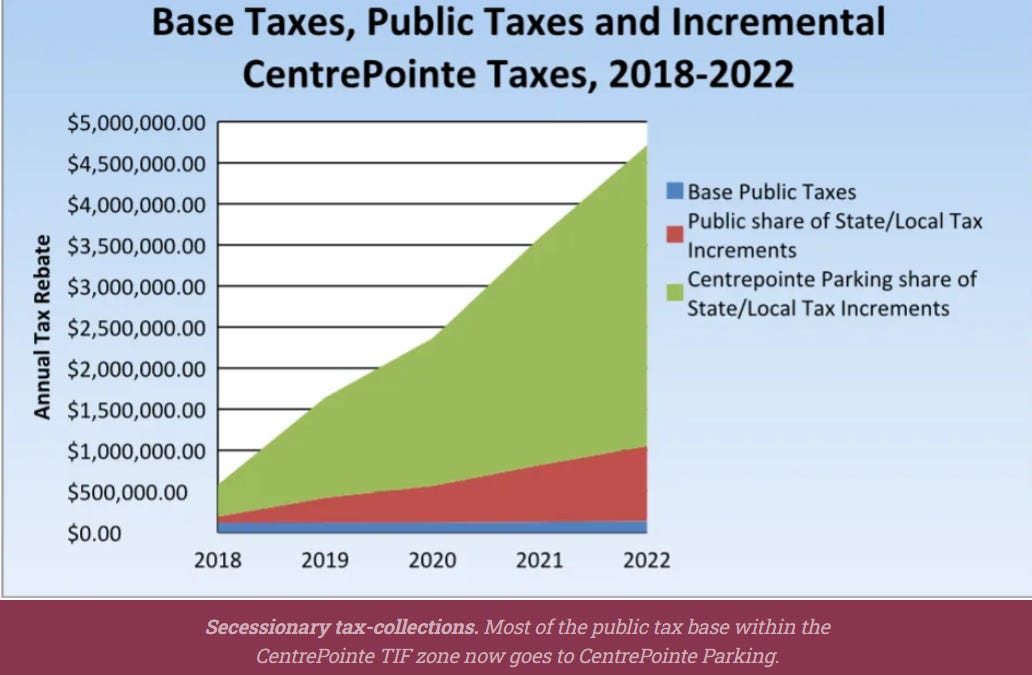

But FOI documents do suggest that the current aggregate annual amount of city and state taxes sent to the garage company, a TIF pool that includes the taxes paid by Old Courthouse patrons and employees, likely now exceeds $4 million annually.

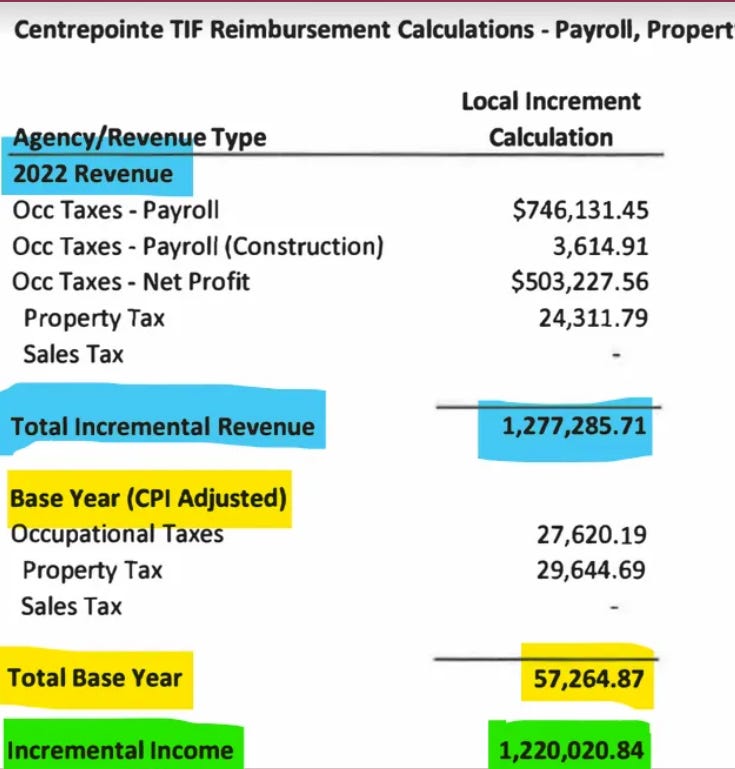

Here are the numbers through 2022, a year that saw the city and state remit to Centrepointe Parking Company over $3 million in taxes generated within its TIF zone.

Inclusion of the new Old Courthouse may have benefited the CentrePointe TIF in other ways.

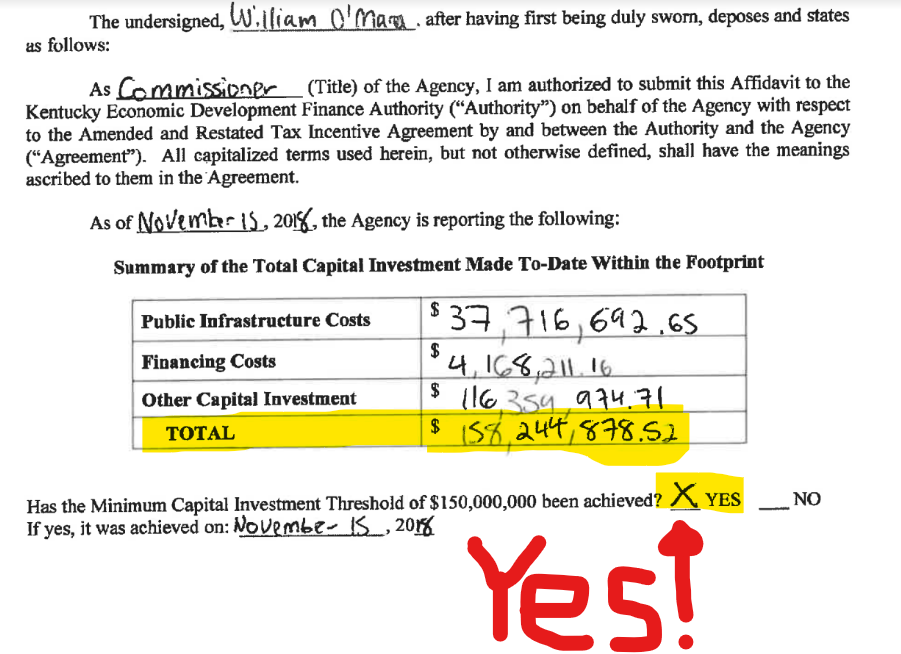

As a “Signature” level TIF, the CentrePointe developers were required to reach a $150 million investment threshold before gaining access to the TIF zone’s “tax increments.” In theory, the threshold compels developers to have “skin in the game” before receiving millions in TIF subsidies. Because renovation took place within the CentrePointe TIF zone, the $32 million costs for the publicly-financed Old Courthouse renovation helped the developers reach their minimum threshold more quickly.

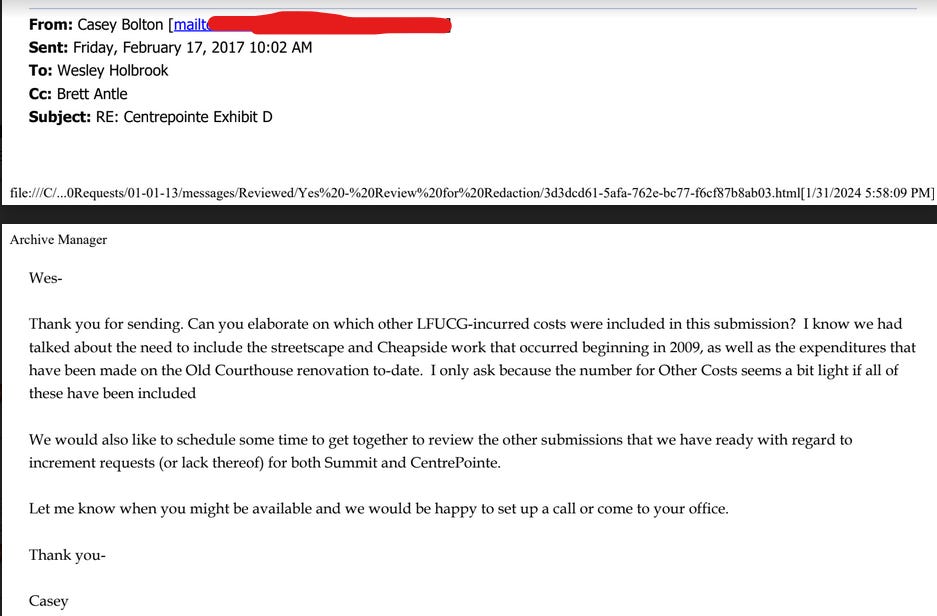

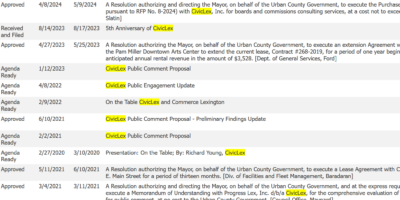

Here is Casey Bolton of Commonwealth Economics, the group representing CentrePointe Parking Company, LLC, bringing this up in 2017 to SFUC Director of Revenue Wesley Holbrook.

Bolton writes:

Can you elaborate on which other LFUCG-incurred costs [toward minimum threshold] were included in this submission? I know we had talked about the need to include the streetscape and Cheapside work that occurred beginning in 2009, as well as the expenditures that have been made on the Old Courthouse renovation to-date. I only ask because the number for Other Costs seems a bit light if all of these have been included.

The CentrePointe TIF reached its mimimum threshold in 2018, the same year that city leaders were hailed throughout local media for completing the Old Courthouse renovation.

Inclusion of the Old Courthouse also artificially depressed the Baseline Tax for the CentrePointe TIF. The Baseline Tax is the amount a TIF zone generates in taxes the year before development. This figure, along with the TIF Zone’s Total Tax, helps determine the size of the annual “tax increment” claimed by the developers.

As a rule, TIF developers want a low Baseline Tax and a high Total Tax, as this provides maximum value for their Tax Increment. (For more on Baseline Taxes and Tax Increments, see my TIF explainer.) Here is an example from the CP TIF’s 2022 ledger:

In 2008, the year used to determine CentrePointe’s Baseline Tax, the Old Courthouse stood virtually vacant and was about to be condemned. The building generated no property taxes and collected virtually no consumption taxes. When averaged with the rest of the lots lying within the CP TIF zone, the all-but-abandoned property suppressed the Baseline Tax amount.

At the other end of the TIF tax spectrum, the subsequent addition of four high-end businesses inside the Old Courthouse has contributed to the ongoing increases in Total Tax revenue generated annually within the CentrePointe zone. As you might expect, this figure has taken off since the 2021 return from the Covid shutdowns.

Because the Old Courthouse portion of the TIF site previously generated next-to-nothing in taxes prior to the city’s $32 million taxpayer investment, it is likely that closer to 100% of the local and state taxes generated by business at the renovated site go to CentrePointe Parking Company, LLC. These would be taxes paid on items like an $18 Downtown Hot Brown at Zim’s or a $50 shot of top flight bourbon at the Thirsty Fox. Or on a half million dollars in bonuses paid out to VisitLex mployees. Or on VisitLex client lunches at any of the restaurants within the CP TIF zone. Or high fash weddings at the newly renovated downtown event space that overlooks Lexington’s honest attempt at the French Quarter. Just about all of it, to them.

The upscaled Old Courthouse is not likely to be the only TIF gift given at taxpayer expense to CentrePointe Parking Company, LLC. The map suggests that the company has likely already received the taxes paid toward the development of the Vine Street portion of the TB Commons—the Clean Commons—which runs along its southern border.

Above the new Old Courthouse, the CP TIF zone also includes two undeveloped surface parking lots.

Like the new Old Courthouse, these two vacant lots also contributed to the TIF’s low initial Baseline Tax.

And because the CP TIF runs 30-years, any development of these high-value urban surface parking lots will most certainly benefit the owners of CentrePointe Parking Company, LLC, who can expect to receive just about all of the taxes generated by whatever in the Fayette Urban County happens to get built there.

Future Lexington historians might interpret such TIF deals as localized expressions of the secessionary zeitgeist, places where alternate forms of governance and tax collection emerged from the general twenty-first century fraying of authority across the territories. Little Lichtensteins.

If so, the microstate of CentrePointe Parking Company, LLCs (the surely democratic sounding CPPC, LLC), seems well-positioned. It already has a completely re-done courthouse to inhabit, underground bunker parking for dignitary visits, established trade networks with nearby UK, a killer food culture, and, on a per acre basis, access to some of the region’s highest aggregate tax base.

Leave a Reply