Why public higher education should not wager on precious metals

By Andrew Battista

Most people agree that the U.S. economy imploded because brokers were placing wagers on whether or not people would be able to pay their mortgages. The idea of mortgage debt became a speculative bubble that could not be sustained. Now, in place of one collapsed futures market, the real estate and mortgage industry, the country has developed a twinkle in its eye for another: precious metals commodities trading. Our infatuation with gold in particular is as intense as it’s been in at least a century. One needs to look no further than the Discovery Channel, which features a reality series about modern-day speculators who solicit benefactors to fund backcountry mining expeditions. These working-class men, caricatures of American ingenuity, take a fleet of expensive equipment and ravage our last frontier, the Alaskan tundra, as they look for shards of gold now selling for $1700 per ounce on the market.

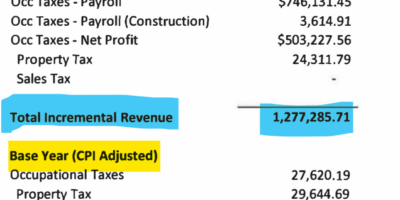

Another place to look for gold fever is at our top colleges and universities. Some of the United States’ public, land-grant institutions, which are ostensibly charged to prepare citizens to be engaged in an interconnected democracy, have fueled this gold rush by investing portions of their endowments in the metal. Last year, several major news venues took notice when the University of Texas bankrolled one billion dollars, or about five percent of its massive endowment, in gold. The university’s investment manager, Bruce Zimmerman, went on CNBC to brag that his team had actually taken possession of “the bullion,” or 6,643 physical gold bars that are kept somewhere in an undisclosed New York City vault.

Zimmerman explained that the decision to sink a billion dollars into hunks of metal was a “hedge against currency devaluation,” and for a while, he looked shrewd. The price of gold ballooned over the summer, which earned an estimated billion dollars for the university’s fund at the peak of the bubble. As I watched Zimmerman’s interview on television, I tried to imagine what would happen if the University of Texas started sending out flakes of gold in an envelope each month to retired professors in lieu of direct deposits into their bank accounts.

At the University of Kentucky, it’s a little harder than at Texas to know where the endowment is dispersed. I haven’t been able to find out if UK has its hand in the gold market, but I do know that board of trustee member James W. Stuckert is a longtime beneficiary of gold futures. Even though he primarily works as the CEO of Hilliard Lyons, Inc., he’s done some side consulting over the last twenty years for Royal Gold, Inc. According to Forbes, Stuckert earned over $150,000 in 2010 for what appears to be an advisory role on Royal Gold’s board of directors. Not bad for a part time gig.

Gold’s sad investment

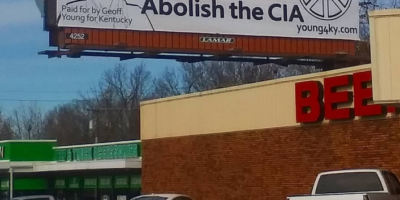

There are many sad ironies in Texas’s investment portfolio, not the least of which is, as Thomas Frank says in Harper’s Magazine, that one of our nation’s most highly-reputed bastions of intellectualism has adopted an investment strategy that is fundamentally anti-intellectual. No serious economist, teaching at Texas or elsewhere, would ever argue that the gold standard is something the United States Federal Reserve could or should maintain. In fact, most economists, even some conservative ones, would argue that the current gold rush is nothing more than a new futures market, a special one that rises and falls with the degree to which people are disaffected with the federal government, taxes, Barack Obama, and, well, just about anything.

Those who put their gold where their mouth is seem to think that trading in precious metals is a way to evade the bitterness of the present. For these people, gold is the currency of a post-apocalyptic world in which interconnected economies have imploded and only strong, self-sufficient people survive. According to so called “metal-heads,” gold is not subject to the foibles or contingencies of Wall Street, the whims of government, or the avarice of financial institutions that speculate on other people’s hypothetical bank accounts without consequence. People who are suspicious of governments trade in gold because they think it’s stable and finite.

Nevertheless, the reality is that anyone can “print” more gold at any time by mining it (if you’ve seen the Discovery Chanel show, you know that I really do mean anyone). Gold is just one among many arbitrary signifiers of value, albeit a signifier that has some profound natural barriers to access. The process of digging through the earth to find gold flakes can be time-consuming, expensive, and dangerous. Still, from the vantage point of public institutions of higher learning, buying gold isn’t so much of an investment strategy as it is an ideological statement that our nation’s public institutions have no right to make. An investment in gold is ultimately a wager that the United States will fail. For public universities to gamble against the success of our own democracy is insidious, not only because those very same institutions are supported by the federal government, but also because investing in gold undermines the very ideals on which our public universities were founded.

The Liberal Arts

Say what you will about the United States, but at least we are a nation that realized from the start how important education is to a sustainable democracy. Thomas Jefferson, who played a big role in setting our country’s course, established a public university system because he knew that it would make the new democracy possible.

In a letter to George Wythe in 1786, Jefferson wrote, “Preach, my dear Sir, a crusade against ignorance; establish and improve the law for educating the common people. Let our countrymen know that the people alone can protect us against these evils, and that the tax which will be paid for this purpose is not more than the thousandth part of what will be paid to kings, priests and nobles who will rise up among us if we leave the people in ignorance.”

At the core of Jefferson’s vision was an education in the liberal arts, the pursuit of knowledge from many spheres and from many perspectives. A liberal arts education is holistic; it covers all knowledge that is befitting of one who lives in a free society. A liberal arts education prepares students to be excellent citizens, critical thinkers that draw on many disciplines as they interpret their experience in the world.

Unfortunately, there is a connection between what is happening to liberal arts programs and university endowment hedge funds. Even as universities momentarily turn profits on commodities market speculation, they turn around and cite constricted federal budgets as reason to reduce liberal arts funding.

Not surprisingly, the University of Texas is a great example of this pattern. While Zimmerman and his fellow gurus upped their stake in a wager that inflation will ruin America to make the university a billion dollars in a few months, the Texas administrators respond to shortfalls in federal funding by slashing liberal arts programs. According to The Daily Texan, UT Austin’s student newspaper, UT Vice President and chief financial officer Kevin Hegarty announced that in the next year, the College of Liberal Arts will be forced to cut $3.5 million of its $4.7 million dollar budget. Is any other sector in the university expected to make such sacrifices?

The cuts at UT Austin are among an increasing trend in higher education to destroy liberal arts programs in the name of fiscal expediency. Louisiana State University has cut its programs in Latin and German, and SUNY Albany announced in the fall of 2010 that it will respond to statewide budget shortfalls by cancelling its French, Italian, Russian, Classics, and Theatre majors altogether. All faculty, tenured and non-tenured, were released. It seems that under the current economic order in most universities, administrators will no longer justify liberal arts disciplines because the cost to educate students in them is not offset by the revenue they generate. Education gets reduced to the laws of the marketplace. Money becomes the measurer of man.

These announcements are typical of higher education’s ongoing and near-wholesale transformation from service-oriented centers of education to corporatized industries that swear by the rules of our capital market. Higher education has priced out everyone, save our nation’s upper-middle class and elite. Those who do get the opportunity to attend college will work their way through watered-down curricula, which unfortunately have minimal opportunities to study literature, history, language, theology, rhetoric, and culture. Meanwhile, the gurus that run our university endowments make wagers that our nation’s economy will continue to fail.

At stake is not simply the future of liberal arts inquiry, where students can pursue knowledge in all quarters. It is the sustainability of American democracy, an interconnected society that implores its citizens to seek knowledge. The survivors in a crumbling democracy will have to do a little more than figure out how to find alternative currencies to replace the over-inflated US dollar. They will have to figure out what kind of critical thinking makes the idea of democracy possible at all and whether that kind of learning can be traded for gold on a futures market.

Leave a Reply